A little more than a year ago I was gifted a smart speaker by a friend for Christmas. At the time I was suspicious of installing an always-listening device in my home and had no streaming subscriptions or other smart home devices. Fast forward 12 months and I’m excited to say that I now have several smart speakers throughout my house that allow me to stream my favorite music on demand. Best of all, since they allow me to control other devices with just my voice, I also have a host of smart home devices ranging from robot vacuums to lights and cameras and streaming sticks to name just a few.

While I still have concerns about privacy, I – like many other consumers – have been happy to push these aside in favor of the enhanced entertainment and conveniences that these smart speakers have afforded me and my household. This includes turning on the kitchen lights, playing music, and displaying recipes while I’m making dinner, and asking my robot vacuum to clean up a mess on the floor without having to open an app on my phone, just to name a few.

The smart assistant (SA) market is evolving at a tremendous pace, and SA platforms are emerging as a core mechanism through which consumers interact with their smart home ecosystem. SA platforms have moved quickly from being a novel voice interface for PCs and smartphones to becoming a central part of connected homes in the form of smart speakers. These platforms not only enable consumers to access a wide range of services — from video and audio entertainment, information, communications, and online shopping to calendaring, reminders, and booking hotels, to name a few. More importantly, they are also quickly becoming the cornerstone of the wider consumer IoT ecosystem by enhancing the accessibility, use, and functionalities of internet-connected devices.

Additionally, these platforms are uniquely positioned to help consumers overcome many of the barriers to smart home device deployments by removing the complexity surrounding IoT devices and enabling a new level of interoperability and home automation. Effectively, they drive richer, personalized, and contextualized digital experiences in the home.

Amazon, Apple, Google, Microsoft, and Samsung’s collective effort and research are driving the recognition and widespread acceptance of consumer-based SA applications. However, the overall market for smart assistants is nascent with most consumers failing to fully utilize the services and applications that smart assistants offer, and much confusion exists surrounding what exactly is a smart assistant and how they fit into the broader consumer IoT ecosystem.

Smart Speakers: By the Numbers

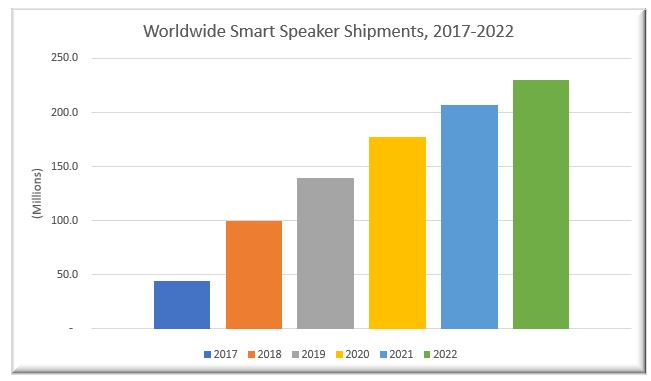

IDC’s recent smart home forecast shows the total worldwide number of smart speaker shipments reaching 99.8 million units by the end of 2018, and up to 230.5 million by the end of 2022. Driving this explosive growth is a combination of factors: rapidly rising consumer awareness of and demand for connected speakers with a built-in smart assistant; a recent influx of new vendors and products entering the market; and incumbents significantly expanding their portfolios of speakers and services. Smart speakers will continue to witness significant growth over the next several years as consumers look to these devices to become one of the critical touchpoints to a consumer’s smart home ecosystem.

Source: IDC’s Smart Home Device Tracker, November 2018

The range of devices that can be integrated with a SA and controlled though a smart speaker is constantly growing. SA platforms are beginning to expand their reach beyond speakers to be embedded directly in a myriad of connected household devices like thermostats, appliances, TVs, streaming players, security cameras, and almost any other device imaginable that has a microphone and speaker inside. However, given the benefits of smart assistants and the ever-expanding scope of devices in which a smart assistant can be accessed, what’s holding many consumers back from talking to one today?

Leading Barriers to Smart Assistant Adoption

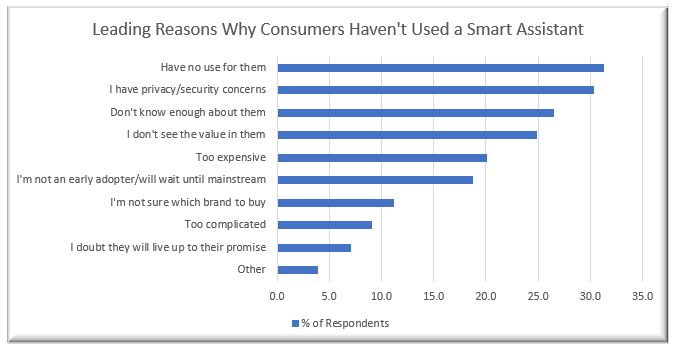

IDC’s Consumer IoT Survey indicates that a perceived lack of need as the leading barrier to adoption, common to all new technologies. But look at how high privacy and security ranked. Privacy and security concerns will invariably arise whenever new systems emerge that enable large-scale data collection, transmission, and curation. Smart assistant-embedded devices are no different, and there will be significant concerns raised over having pervasive data collection and transmission systems in the home.

It is almost certain that there will be widely publicized implementations or missteps that cross the line when it comes to privacy and data security. The near-term impact will require vendors to design with security and privacy in mind. As with all smart home applications, solution designs should incorporate security from the beginning. Privacy, however, will be trickier, since many of the core features and functions of smart assistants are around the collection, transmission, and curation of private data. While near-term privacy concerns may seem daunting, in the long term, privacy issues subside if the value proposition proves significant enough.

Source: IDC’s Consumer IoT Survey, June 2018 (N=1,502)

The Road Ahead for Consumers and Vendors

The road ahead for consumers in their adoption of smart assistant platforms is paved with both promise and uncertainty. There is much to be gained from interacting with a smart assistant that can enhance entertainment experiences and deliver efficiencies in time, energy, and costs for an individual or household. But the threat of security breaches and having to sacrifice privacy – not to mention the ongoing costs associated with smart assistant devices and services – will continue to inhibit the market’s growth for the foreseeable future.

On the supply side of the market, smart assistant platform vendors need to:

- Be mindful that consumers are sensitive to prices, security, and privacy issues, and design products and services accordingly

- Remove the complexity and uncertainty that surround smart assistant platforms, build trust, and tailor marketing efforts to the right audience

- Take a meaningful and purposeful approach to integrating with a broad range of other consumer IoT devices

On the demand side, consumers need to:

- Explore the ways in which smart assistants can enrich their lives by researching companies and products to make informed decisions

- Talk to friends and family members that are further along in their smart assistant journeys to better understand which platforms best meet their own needs

Learn more about consumers’ adoption of and attitudes toward smart assistant devices and applications – including market drivers, inhibitors, leading use cases, and more.