IDC has been tracking technology spending in the Worldwide Black Book since the 1980s, and you’d be forgiven for thinking there are fewer surprises and unexpected statistics today. The technology industry is now a much more mature sector of the global economy, even compared to as recently as the early 2000s.

Overall IT spending may be more predictable than in the past, as an increasing share of end-user tech spend moves from volatile Capex to relatively stable Opex thanks partly to the growth of cloud and mobile, but the key to gaining competitive advantage still lies in being first to recognise significant shifts, anomalies and surprising trends. Here are just five of them.

1: New technologies will drive another IT wave from 2020

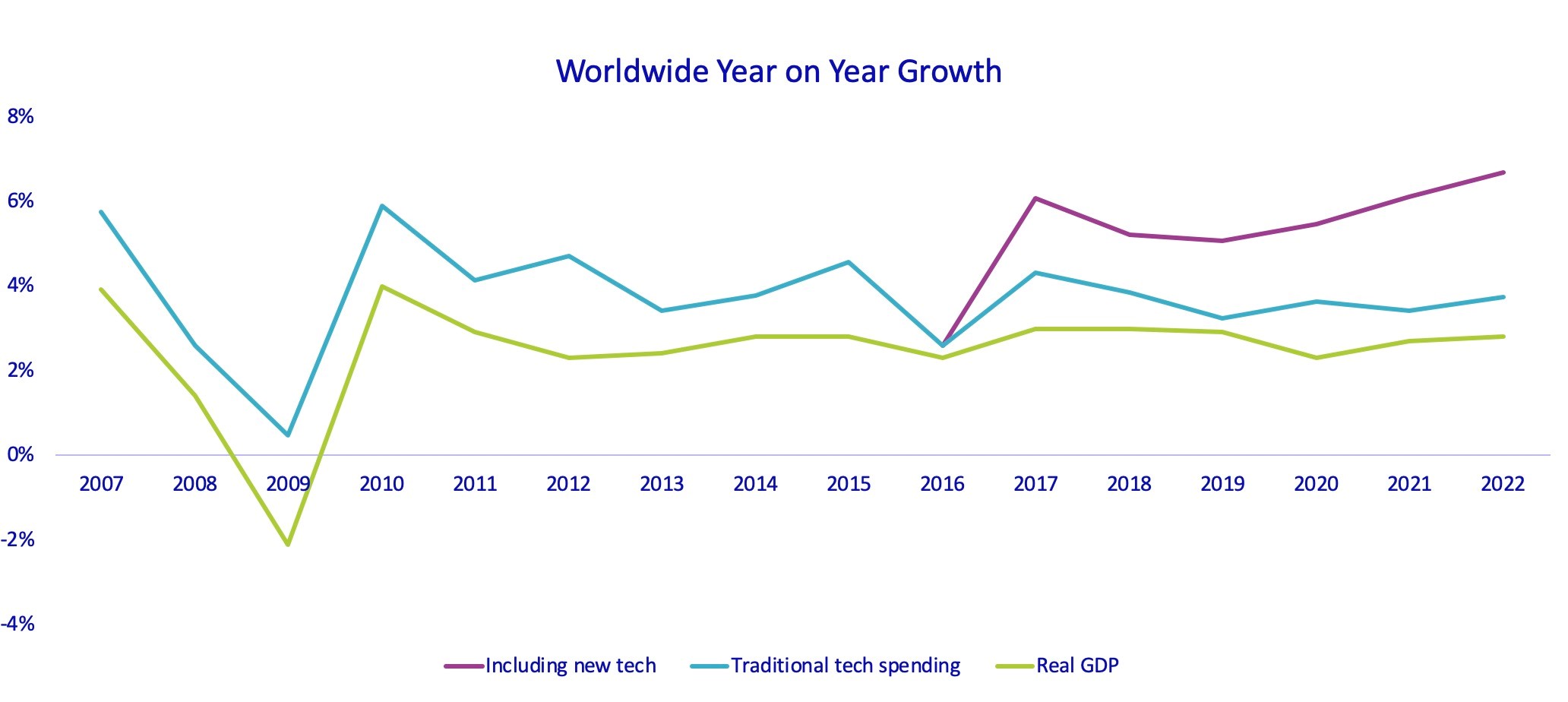

Traditional ICT spending (hardware, software, services and telecom) is now broadly tracking GDP. While that varies by country, and emerging markets continue to drive a gap between the annual pace of ICT and the rest of the economy, the traditional tech sector is now closely following overall sentiment and investment as a lagging indicator. However, by 2020, new technologies including IoT sensors, drones, AR/VR viewers and 3D printers will drive a new surge in overall industry growth as these growing markets begin to account for a larger share of the pie.

As shown in IDC’s 3rd Platform Black Book, total ICT including new technologies will accelerate to more than 6% growth from 2020 , and reach more than $6 trillion in annual spending by 2022. This includes a large (and growing) market for new OT software and services attached to emerging hardware categories. Where the current decade is a story of cloud and mobile, the next will be characterised by ubiquitous computing and digital transformation.

2: China is a different world for IT vendors

It’s no secret that China has emerged as a huge ICT market in the past decade, and now accounts for 12% of traditional ICT spending (up from 7% a decade ago). But much of that reflects the explosion of smartphones, where China has increased its share of worldwide spending from 6% in 2008 to almost 30% today (and to almost 20% of mobile voice and data services).

It’s a different story in software and IT services, however, where China still accounts for only 3% of global market value. Outside of large multinationals in major cities, China remains a tough market to crack for software vendors (on average, companies in China still spend less than 8% of their annual IT budget on software). High levels of software piracy are one factor, in addition to regulatory nuances, along with slow development of local software ecosystems beyond the core manufacturing base which still accounts for a large share of investment.

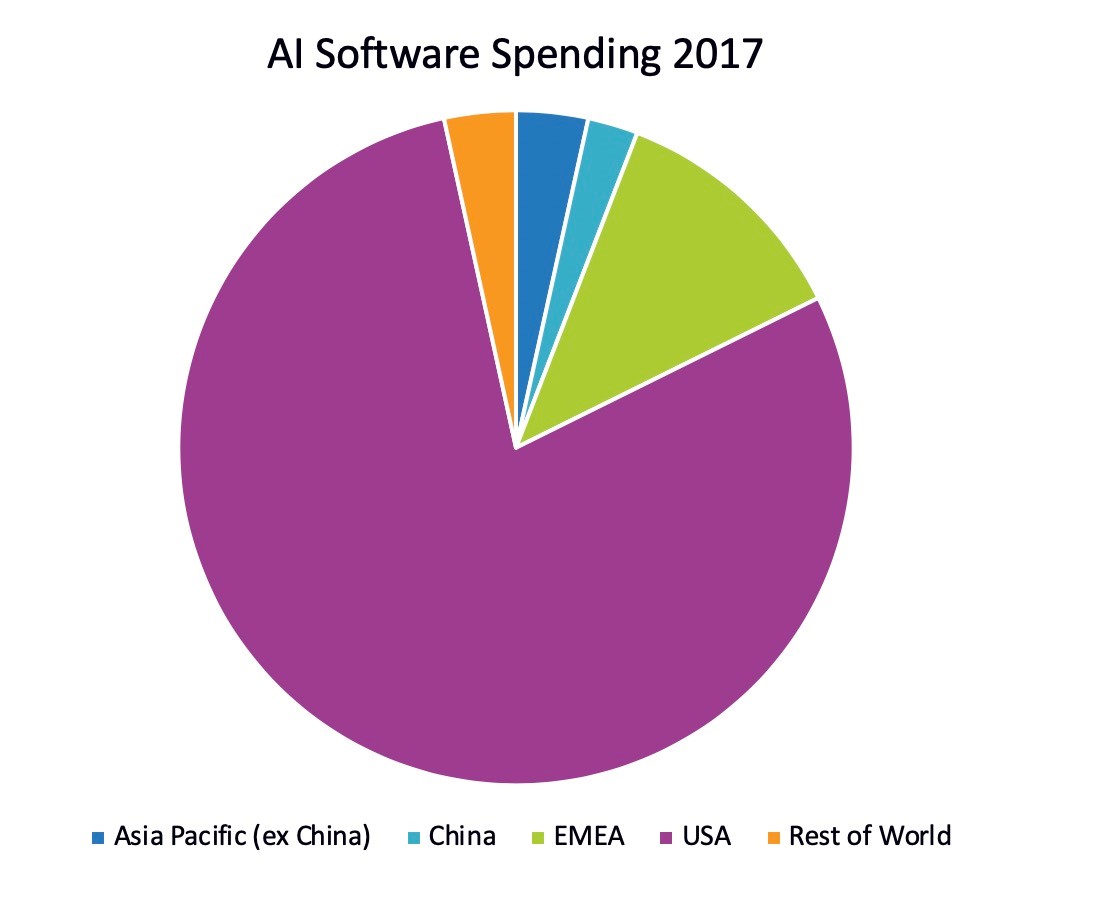

In fact, a much stronger opportunity in China exists for vendors of non-traditional OT (operational technology) software around IoT and robotics deployments in manufacturing plants and other relevant industries. This focus on OT technology has helped to power China’s emergence as a manufacturing powerhouse, which is a leader in adoption of some new technologies, accounting for the largest share of IoT (27%) and robotics (31%) investments having overtaken the US. But it lags behind in software markets like big data & analytics or AI software, where it accounts for only 2%. If China is to expand beyond its reliance on manufacturing exports, it will need to accelerate investments in new software which can drive economic benefits across a broader swathe of the economy.

3: Except for smartphones, hardware devices are in a death spiral

The smartphone industry has continued to expand in terms of overall value, despite experiencing its first-ever decline in annual unit sales, by migrating users to higher-priced midrange and premium devices. This looks set to continue, even if price points in mature economies ($1000+ and counting) begin to saturate in the coming years. There are still a large number of mobile users in emerging markets like China and India who are set to move up the smartphone chain from entry-level devices to midrange and premium handsets in the next 5 years.

Other hardware device markets have not been able to replicate this trick. Spending on PCs did rebound to positive growth in 2017, thanks partly to spending on higher-priced notebooks and new form factors (although much growth was also driven by cyclical corporate upgrades), but this won’t last. The overall PC market is expected to decline for most of the next 5 years, even if it ekes out a bit more residual growth in 2018. Tablet sales have never recovered from the rapid commoditization process which followed hot on the heels of the initial iPad-driven explosion and will continue to post year-on-year declines as consumers hold onto tablets for longer and gravitate towards low-cost devices (although there is growth in sales of premium commercial tablets).

It’s not much different for other markets, like printers and monitors, which now resemble commodity technologies in terms of annual spending (more like TVs and radios than high-tech). You probably already knew that the IT devices market had seen a rush to the bottom, but you might think the worst is over. In fact, excluding smartphones, it’s set to lose another $30 billion in value over the next 5 years, by which time it will have declined by a third in the course of just 10 years.

4: When it comes to software, the US is still leagues ahead

Just as China leads in smartphones, IoT and robotics, the US still dominates when it comes to early stage investments and deployments of cutting-edge software. You probably know that the US is still at the forefront of the global software industry, but the statistics are stunning. In 2017, the US accounted for almost 80% of worldwide spending on AI software, more than 50% of big data and analytics, 67% of security and almost 60% of enterprise social.

While some of this reflects the tendency of US firms to prioritize investment in bleeding-edge software which can deliver rapid productivity benefits across multiple sectors of the economy, in addition a strong ecosystem of US software firms and channel partners, it also partly reflects the aggressive adoption of cloud computing which has enabled businesses to aggressively roll out new software products to their employees. In 2017, the US accounted for almost 70% of all worldwide spending on cloud-based software, and more than 40% of spending on infrastructure as a service. This has also driven radical implications for infrastructure vendors, as cloud providers have grown to account for an increasing share of spending on servers, storage and network equipment (and have helped to drive a boom in datacenter hardware spending over the past 5 years). A cloud-first, mobile-first approach has been a foundation for emerging digital strategies which are now driving rapid investments in new technologies like AR/VR and AI.

All of this means not only that the US remains the most profitable market for software and services vendors, and a crucial testing ground for new software products, but also that the US economy benefits from the broadest benefits in terms of the impact of IT spending on productivity, jobs and GDP growth. If there’s one thing the US needs to keep doing in the short term, as its economic position is challenged by China and other emerging powerhouses, it’s to maintain the current pace of investment in new software.

5: A trade war could trim almost $200 billion from IT spending

While ‘IT as a service’ means that IT spending is more predictable than in the past, when a larger proportion of market value was tied to capital budgets, it is not immune to external factors. In recent years, tech spending in Europe has been disrupted by the debt crisis and more recently by Brexit. The emerging markets slowdown which led to recession in countries like Brazil and Russia also led to major cutbacks in tech spending by businesses and consumers. The US hasn’t experienced a significant slowdown since the financial crisis a decade ago, but the potential stakes are higher than ever before as we enter the next 10-15 years, as many businesses move beyond early-stage and prototype deployments into broad adoption of new technologies and uses cases related to AI, IoT, robotics, AR/VR and other new categories.

That’s why an economic slowdown would come at the worst possible time, in terms of its potential impact on stalling the productivity benefits which look set to be unlocked by the next wave of tech spending. The US economy is already forecast to lose some momentum in the next 2-3 years (a contraction is overdue, by historical standards, and history would suggest that the coming period of interest rate hikes will inhibit spending and growth to some extent).

An all-out trade war could help drive the US into a recession, if the current dispute with China escalates into a broader trade conflict with other regions (although the recent successful negotiation of a new treat with Canada and Mexico has removed some of the downside risks). Based on historical correlations between economic indicators and IT spending, a worst-case scenario for the trade war could see a major hit to US IT budgets between now and 2020 as businesses are forced to engage contingency measures in the face of slowing growth and sentiment. Other regions would be impacted too, but potentially to a lesser degree (partly because other countries would increase trade with each other, and partly because China in particular is still subject to a likelihood of government intervention in the short term which would prop up investment and availability of capital/credit.

For now, the US could probably weather a temporary escalation in its current strategy of tariffs and protectionist trade policies without doing permanent damage to productivity. The danger is that a conflict rolls on beyond 2020 and becomes a crisis without a clear endgame, potentially choking off the sense of optimism and experimentation which has driven such aggressive deployments of innovative new technologies by US firms in the last 10 years. A lot is at stake, when it comes to the impact that IT spending still has on the performance of a country’s entire economy. Globally, an all-out trade war could trim almost $200 billion from current tech spending expectations by 2020.

Learn more about the latest ICT spending data and leading economic indicators for ICT budget trends, and new 3rd Platform technologies.