Global EV Market Landscape

The automotive industry is facing the most important transition period in its history — the replacement of the traditional internal combustion engine with more sustainable, energy-saving, and environmentally friendly technologies. The traditional engine has dominated powertrains for more than a century.

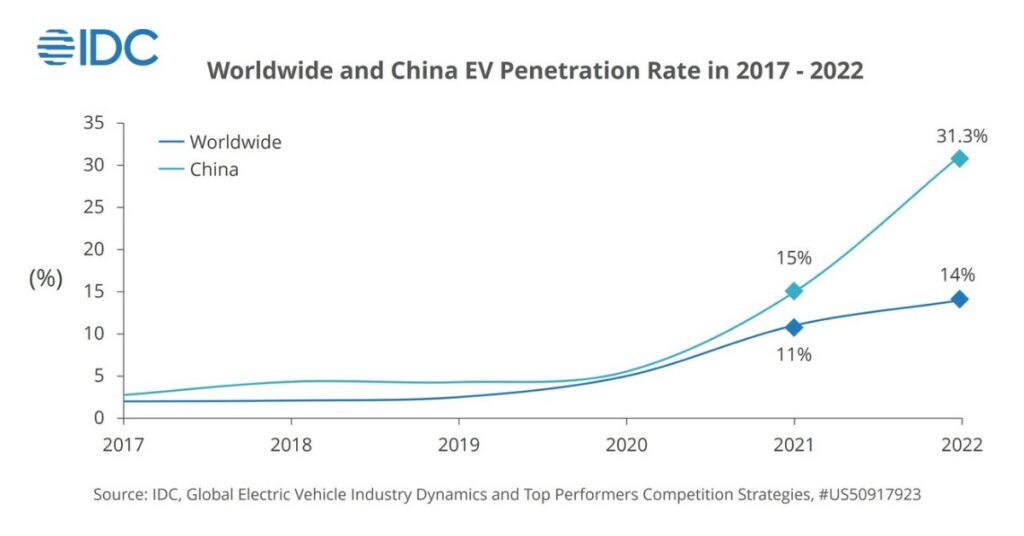

In 2022, the worldwide Electric Vehicle (EV) market exceeded 10 million units, with a penetration rate of14%. In 2023, it is expected to reach 14 million units, with a penetration rate of 18%. Overall, China and Europe are leading the market, whereas the United States and other developing regions have great potential.

Electrification, connectivity, autonomous driving, and ride sharing are the four key trends that drive this transition, resulting in the rapid growth of the global EV market. From supply side, governments take EV as a country strategy, providing subsidies to promote players developing their business.

More investments in R&D and innovation have resulted in breakthroughs in core technologies, such as 5G, OS,V2X etc. As such, traditional OEMs, technology giants, and emerging players are trying to seize the opportunities from the electric vehicle market. From the demand side, more and more customers are now preferring green travel and are willing to pay for intelligent functions.

In 2022, top 3 players in the EV market worldwide were BYD, Tesla, and SAIC-GM-Wuling, with Tesla falling behind BYD. Due to the emergence of more and more electric models from other players, Tesla’s market share has continuously eroded, falling from 17% in 2019 to 13% in 2022. It is expected to stabilize at around 10% in the future. Tesla needs to diversify its product line with a cheaper compact car if it is to regain the number one spot.

The industry transition will be fast, both opportunities and challenges exist. Only by establishing advantage in advance, can the players get ahead of their competitors and win the final victory.

The competition in the EV market is fierce and here are some of IDC’s advice for OEMs to capture opportunities from this market:

- Targeting Valuable Markets: Continue investments in the most valuable markets: China, Europe, and North America. China and Europe are the leading electric vehicle markets, with strong government subsidies and promotion over the last few years, and high customer awareness. In these markets, the competition will become more intense, and products will become more segmented. The United States has also begun to drive the electric vehicle market. The Inflation Reduction Act (IRA) signed on by the Biden administration in August 2022 has had a significant impact on the electric vehicle industry. Some developing countries are also showing potential, such as India, Thailand, Philippines, Indonesia, etc.

- Strong Company Positioning: The leading companies in the EV market position themselves as energy or technology companies, which are bigger than automotive, while maximizing synergies between different business portfolios. Overall, high-end brands are beginning to penetrate the low-end, and low-end brands are trying to break through to the high-end. Segmented markets and high-quality EV products have become competitive hotspots.

- Technology Strategy: Choose the most suitable technological route, such as low cost, time to go to market, high-quality product, etc. At the same time, increase investments in R&D and innovation, especially for software.

- Create a High-Tenacity Supply Chain: Actively consider changing their original pure outsourcing strategy and more actively arrange upstream core components from a strategic perspective, to enhance their control of the supply chain. What is more, build a more digital and intelligent supply chain management system to increase resilience and agility.

- Talent Strategy: Talent has become more and more important for industries today, including OEMs. Start as early as possible to discover talent and skills shortages, especially around the areas of the Internet, AI, information communication, energy, and power. Build healthy and attractive systems to attract top talent and maintain employee satisfaction.

For more information on IDC’s Worldwide Semiconductor Automotive Ecosystem and Supply Chain Research, please visit this page.

Related Reading

- Worldwide Automotive Semiconductor Market Shares, 3Q22: Automotive Power Semiconductors Leaders Improve Shares (IDC, Doc # US50466223, Mar 2023)

- Worldwide Automotive Semiconductor Market Shares, 2Q22: Higher-End Autos and EVs Drive Growth (IDC, Doc #US49683922, Jan 2023)

- Worldwide Semiconductor Application Forecast (Update) (IDC, Doc # US49687722, Sep 2022)