The number of digital native businesses (DNBs), start-ups, and scale-ups has grown exponentially over the past decade and now represents a significant market cap. Despite the economic downturn, Digital Native Businesses should be on your radar as they drive economic growth, create new jobs, and foster innovation. However, their DNA differs from traditional organizations as they are completely cloud driven.

What is a Digital Native Business?

IDC defines Digital Native Businesses (DNBs) as companies built from the start around modern, cloud-native technologies, leveraging data and AI across all aspects, from product development to logistic operations and customer engagement. By leveraging new and emerging technologies, platform services, and marketplaces, DNBs grow and scale fast, disrupt industries, and create new markets.

DNBs set the pace when it comes to product innovation and development; they set new standards in customer intimacy and customer experience. As technology gives them their competitive advantage, even more important in today’s economic environment, they should be on every tech vendor’s radar.

Simone De Bruin, Research Director, Worldwide Digital Native Business, Start-ups & Scale-ups, IDC

DNBs encompass a wide range of both B2B and B2C enterprises, from food delivery to carbon sequestration to cryptocurrency. There are five defining characteristics of DNBs, distilled below as follows:

- Use tech as differentiator – they depend on UX-driven innovation cycles, and use tech to compete or to monetize their services and products. All core value and revenue-generating processes are dependent on digital technologies.

- Are born digital – they are cloud-native and data-driven and being digital is part of their DNA. They have a tech-driven operating model.

- Scale and innovate at speed – with tech-savvy developer and data scientist teams, DNBs aim for rapid growth.

- Have an ecosystem-centric approach – they are highly marketplace-driven and a DNB leverages its ecosystem of stakeholders to drive community-led innovation, dynamically evolve, and co-create offerings.

- Significantly funded – whether it’s venture capital, bootstrapped, or crowdfunded, DNBs enjoy a high degree of funding to support their ambitious growth ambitions.

Why it’s Important to Pay Attention to DNBs

Despite the economic downturn, DNBs should be on your radar. There is a number of reasons for this, but mostly it boils down to a combination of their innovative mindsets, focus on customers, and ability to rapidly scale, leveraging new technologies. Other factors that help set the trend:

- The number of DNBs continues to increase, and the time it takes startups and scale-ups to grow into unicorn status decreases (average 6 years)

- At the same time, traditional enterprises are fading as a concept as their lifespan decreases.

- Compared to 2021, VC investments in 2022 have dropped. Over the longer term though, VC investments and startup initiatives have grown significantly. 2022 again broke records on fundraising levels as well as on dry powder (funds to invest) available.

The rise of DNBs has been set in motion two decades ago and they will continue to be a major source of innovation for some decades to come. The value that startups create is nearly on par with the GDP of a G7 economy. As Eynat Guez, co-founder and CEO of Papaya Global says, “Technology startups are more than catalysts for growth. They are the engine of growth itself. They solve problems no other sector is addressing with innovative thinking, thus pushing society forward – all while creating jobs, stimulating the economy, and attracting foreign investment.”

DNBs scale rapidly and can generate returns unparalleled to those in traditional enterprises. Vendors who aim to engage with DNBs in the traditional way will find it difficult to keep up with their fast-changing requirements. In addition, they represent different opportunities as well. IDC sees vendors engaging in three ways:

- Invest / Acquire – CVC invests in young & emerging startups, and scale-ups. For example, Salesforce Ventures, M12, Workday Ventures etc.

- Partner / Accelerate – Vendors partner with DNBs, start-ups, and scale-ups, or they engage with them through accelerator or incubator programs. Examples include SAP.io, and IBM Sustainability Accelerator.

- Sell-to – Focused on a commercial relationship where DNBs, startups, and scale-up are a new customer segment.

Although there is a fair amount of overlap between these categories, many initiatives are still disconnected and siloed. Vendors should take a more holistic approach to engaging digital native businesses to build longer relationships, partnerships, and commercial relationships. Once a vendor is clear on the type of engagement, vendors need to assess what type of DNBs fit that purpose. The following segmentation looks at the DNB business model:

IDC distinguishes:

- Technology Providers. Providing third-party organizations with next-generation technology products or services (e.g., a chatbot for enabling better customer experience in retail banking, a SaaS tool for analyzing space imagery).

- Technology Enabled – B2B. Offering products or services to businesses where those services are enabled by next-generation technologies at the core (e.g., a B2B e-commerce company connecting businesses with suppliers and manufacturers or a B2B trading platform for SMEs to source products from distributors and wholesalers).

- Technology Enabled – B2C. Offering products or services to consumers where those services are enabled by next-generation technologies at the core (e.g., a car-sharing service enabling consumers to book and locate cars on the fly using an app, a social network for dating, a video-streaming application).

Vendors will look to identify, or recruit, technology-oriented DNBs to invest in, or partner with. The B2C and B2B types of DNBs are more likely a new customer segment. Vendors who want to engage with the next Snowflake, Uber of Instacart need to first be able to identity what type of opportunity they provide, and then have the system in place to cherish and nurture them to grow.

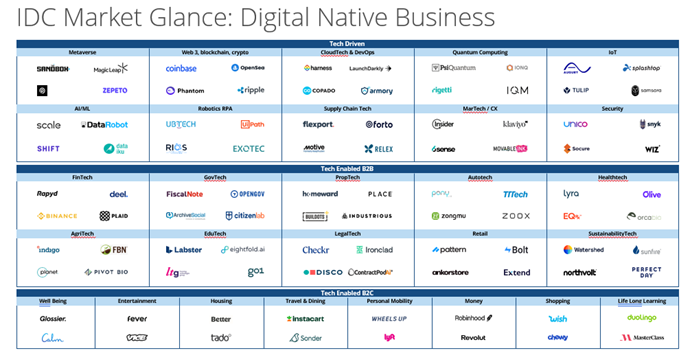

Taking this segmentation one step further, the following subsegments can be distilled to look at high-growth opportunities. Each category within the DNB landscape consists of various functional markets. These functional markets are not mutually exclusive. Metaverse (tech-driven) solutions will impact the (tech-enabled B2B) retail industry that eventually effect the (tech-enabled B2C) consumer tech in fashion for example.

The lifeblood of the Future Digital Economy

DNBs are the lifeblood of the future digital economy. With growing investments in digital natives and an exponential growth of companies born in the digital age, digital natives start to command a sizeable portion of tech spend. However, that tech spend will differ for each of the different categories as defined by IDC. As DNBs exert a strong influence on the market, they should be on the radar of any tech provider. Tech is their key competitive advantage. Even during an economic downturn, they are not likely to downsize their IT investments. However, to get traction and increase engagement there is great value in understanding their business operations, what enables their success, and what their IT requirements are.

- If you’d like to learn more check out our latest research here, or contact Simone de Bruin, Research Director, WW Digital Native Business, Start-ups & Scale-ups

- At the moment we are collecting data from digital native businesses. So, if you are a startup, scale-up, or mature digital native business and would like to participate in our research – and receive our CEO tech book as a thank-you gift, please click this link to participate!