Having a tough time justifying your video surveillance acquisitions? Join the club!

In recent IDC research, we asked the heads of physical security for several major corporations whether they were interested in increasing their video surveillance capabilities. Without exception, they all answered in the affirmative. However, when we asked them if they thought they would have the budgets to increase video spending, they all answered in the negative. Although it is true that IT or Facilities frequently do not receive the budget to implement everything they want to do, we were talking to these individuals during the height of the COVID crisis and when social unrest was at its peak. Why the hesitation?

The Problem: Lack of Demonstrable Video Surveillance ROI

The reasons for the responses didn’t really become apparent until we conducted an extensive global survey of physical security and IT management. While there are many reasons for a low budget priority for video surveillance that were given, the most prevalent was the lack of demonstrable ROI for such investments.

This problem was laid at the feet of video surveillance vendors, who often pitch the value of their products and services in the context of insurance policies: where the value is expressed in terms of the average cost of a physical security breach. Although this can be a logical way in which to estimate value, it is an exercise in risk assessment where the actual risk and cost of failure is unknown. From this perspective, where an investment in video surveillance is often compared to an investment in production equipment with a well-defined return on investment, it is no wonder that the production equipment wins the budget battle. This is actually a rational way for business to behave and, in fact, we all do it ourselves when we decide whether to buy extra life insurance or a new set of golf clubs.

Some vendors have tried to make the case that, if the new video equipment is more efficient or more capable, then the video investment can be justified in terms of a reduction in cost. Yet, this is an argument that ultimately depends on a strong desire of the enterprise to maintain its investment in video surveillance. Many surveys by IDC have demonstrated that much of a company’s video infrastructure is often simply left in place until it fails. In some cases, it is left in place even after it fails. This is especially true of network video recorders (NVRs).

A New Way to Look at Video Surveillance

Yet, in my opinion, we have been looking at video surveillance the wrong way. When video cameras were analog and demanded human observers to be effective, the utility of the video infrastructure was limited to purely safety and security concerns. And, because of the limitations imposed by human observers, video surveillance was used sparingly. The advent of digital cameras combined with video management systems (VMS) and video analytics changed all that.

Digital cameras that could communicate using conventional IP networks changed the cost dynamics of cameras and enabled much larger constellations of cameras, while the application of VMS technology ensured that one human operator could manage many cameras. Video analytics, though, enabled autonomous control of video cameras and relegated humans to a supervisory role. Now automation could look for threats or items of interest and alert a human who could then make a determination of whether a response was required.

However, even with the combination of networked cameras and advanced analytics, the primary application of video surveillance was to augment physical security using video. Now, though, the paradigm for video surveillance is changing: now video can be used in ways that are more business enabling rather than business protecting. And it is this shift from an insurance policy perspective to business process improvement that makes all the difference when trying to justify investments in video surveillance.

The Value of Video

Video is now a valuable source of business telemetry; one that can provide insights into things like process flow and timing. Video can be used in retail to assess the status of inventory and can be aid in analyzing traffic patterns to efficiently layout merchandise displays. Video, as an enabler for applications like object and individual identification applications can be used to enable contactless shopping, where individuals identify themselves on store entry and then simply take what they want from product displays, with the need to check out when they leave the store.

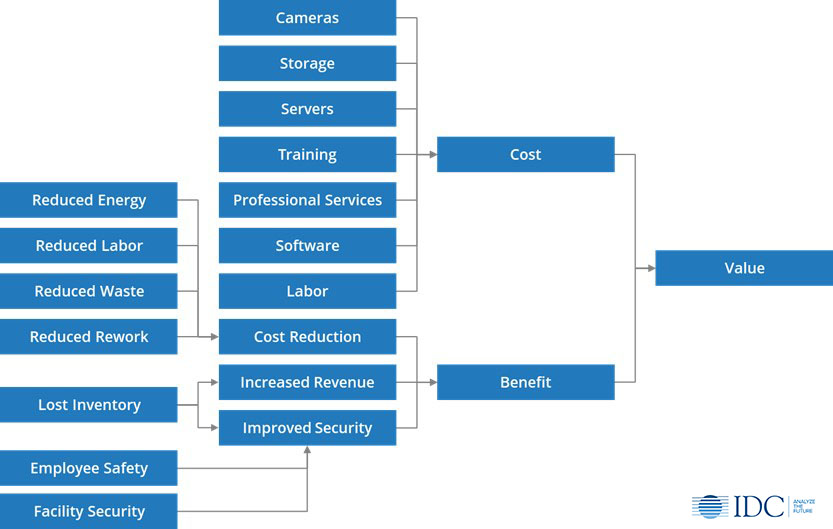

More importantly than enabling business processes, though, is the ability to refine business processes; tuning them for optimum performance. What businesses are finding out is that video enables business planners to see how well things work, where there are potential business process bottlenecks and where modifications in process can yield incremental improvements. Video data is proving that you literally can’t manage what you can’t see. As the following diagram from some of our recent analysis illustrates, the new value assessment for video surveillance not only includes safety and security, but also now includes such things as cost reduction and increased revenue.

An important implication of a cost/benefit value assessment like this is that it is possible to justify video surveillance not only on an unknown potential risk, but on the degree to which it contributes to enterprise profitability. If a variable in this analysis is unknown it can be set to zero or, in the case of a cost, some arbitrarily large number, and if the ROI is positive, then it still makes sense to make the investment. More importantly, if safety and security have been set to zero and the ROI is positive, then safety and security is essentially obtained for free.

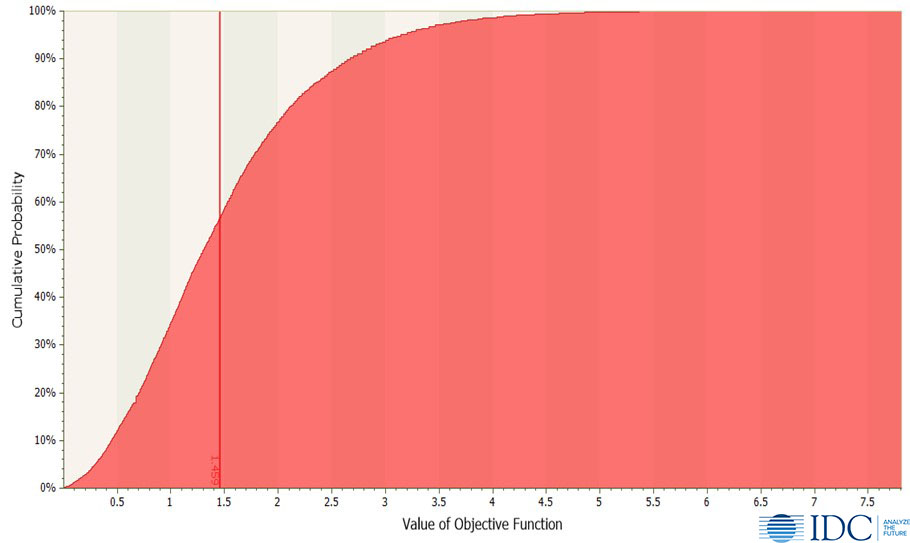

The following figure illustrates the expected ROI for an example video surveillance investment. As shown, the investment shows a positive ROI that can range from zero to over seven million dollars, with a most probable return of about one point five million. Of course, some of the variables for a particular video solution are going to be unknown, but then they can be bounded through analysis, which just happens to be what IDC does.

We work with vendors of video surveillance solutions to quantify their non-security benefits so that they can make a more business centric pitch to prospective buyers. However, if the objective is to acquire better safety and security solutions, then I recommend that the informed buyer insist on vendor input so that a cost /benefit analysis based on business improvement can be conducted.

In most cases, this will require the physical security team partner with IT and business managers to build a comprehensive return on investment assessment. It might turn out to be much simpler than attempting to upgrade video surveillance on the basis of an unknown threat.

The bottom line is that video has emerged as an important source of business telemetry and should be evaluated and implemented on that basis. A positive ROI should be expected just the same as for any other business investment. If justified on this basis, the profitability of the company will be improved, and safety and security will be built in.

See more from our latest IDC Perspective, Video Surveillance in Vertical Applications: Assessing Value of Video Telemetry in Non-Security Applications: