Japan is vigorously revitalizing its semiconductor industry to reclaim its leadership position in the global chip market. To achieve this vision, Japan has implemented a multi-faceted strategy.

First, through strategic subsidies, it has successfully attracted major international manufacturers like TSMC to invest in advanced process technologies, thereby enhancing domestic manufacturing capabilities.

Second, it has established a collaborative model between industry, government, and academia to advance research on 2nm process technology, with mass production targeted for 2027. Japan is also leveraging its strengths in semiconductor materials to develop advanced packaging technologies based on the 2nm process.

By securing a strong foundation in mature processes while advancing advanced processes, Japan aims to achieve its ambitious target of 15 trillion yen in domestic semiconductor sales by 2030.

Due to various historical factors, Japan’s semiconductor industry has largely retreated from the global market, with limited exposure to globalization and maintaining primarily an Integrated Device Manufacturer (IDM) model. Their product applications focus mainly on mature process chips for automotive and home appliances, leaving them technologically behind leading nations. To revitalize their market position, Japan must better understand market developments and competitive dynamics.

For Japanese semiconductor companies, we believe three key developments require close attention in 2025.

Driven by AI, Data Centers Will be the Key Driver from an Application Perspective

The global semiconductor market will maintain growth in 2025, benefiting from the rising demand for AI and generative AI. IDC sees vigorous development opportunities for industries such as IoT, automotive and autonomous vehicles, terminal devices, and communications. Computing power is a must to support these.

Beyond that, coupled with the concept of sovereign AI that has gradually been emphasized by various countries, more expansion is expected in Southeast Asia, India, and other emerging markets for building new data centers. It is also expected that data centers will be the application area with the most significant growth in 2025.

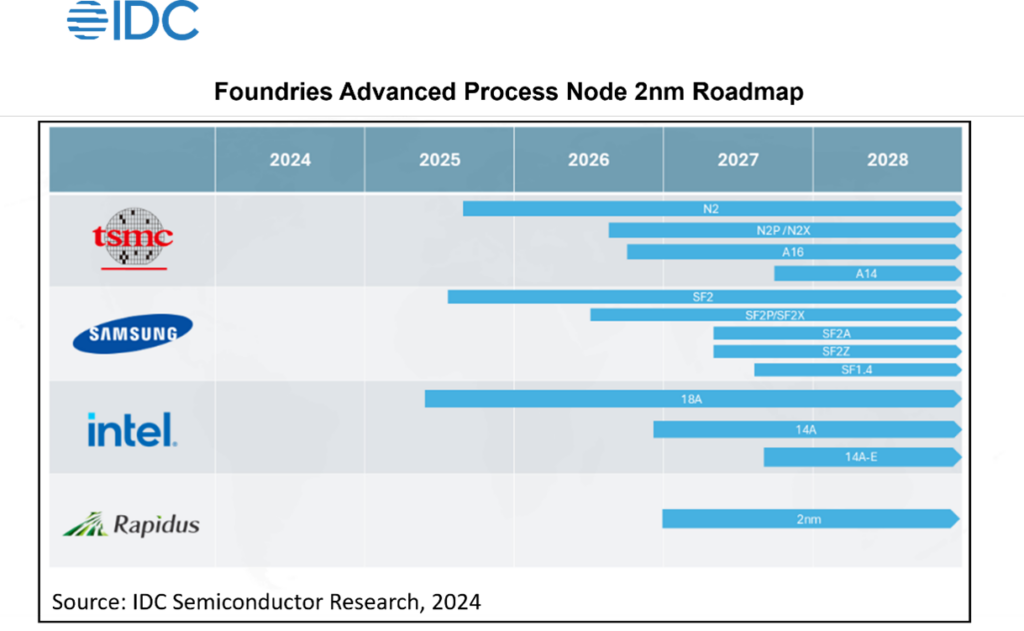

2025 Will be a Critical Year for 2nm Technology

With all three major foundries entering 2nm mass production, 2025 will be a critical year for 2nm technology.

TSMC is actively expanding its fabs in Hsinchu and Kaohsiung, which is expected to enter mass production in the second half of the year.

Samsung, following past trends, is expected to enter production earlier than TSMC.

Intel will focus on 18A, which already has Backside Power Delivery Network (BSPDN), under strategic adjustment.

The above three major players will confront critical optimization challenges in balancing performance, power consumption, and cost per area with the 2 nm technology. In particular, the 2nm technology will simultaneously start mass production of key products, such as Smartphone AP, Mining Chip, AI Accelerator, etc.

By then, the yield rate of each company will improve, and the pace of production expansion will become the focus of market attention.

Chinese Foundry Players are Still Performing Well Despite the Trade Restrictions.

Utilization rate (UTR) of China’s foundry players remains high in 2024, benefiting from the “Design by China + Manufacturing in China” policy and its highly competitive wafer pricing. China foundry players’ UTR is expected to be approximately 87% in 2025.

Driven by the “China+1” policy, there will be more orders transferred from China to Taiwan from U.S. Fabless, which will help Taiwan foundry players’ UTR to improve. IDC expects the UTR of Taiwan in 2025 will be 79%.

Due to policy restrictions on advanced process development, China’s semiconductor strategy focuses on mature process technologies. The current government subsidies are now linked to operational performance, requiring fabs to secure orders and maintain high utilization rates. This will significantly impact wafer prices and competitive dynamics, making it a critical concern for Japanese semiconductor companies.

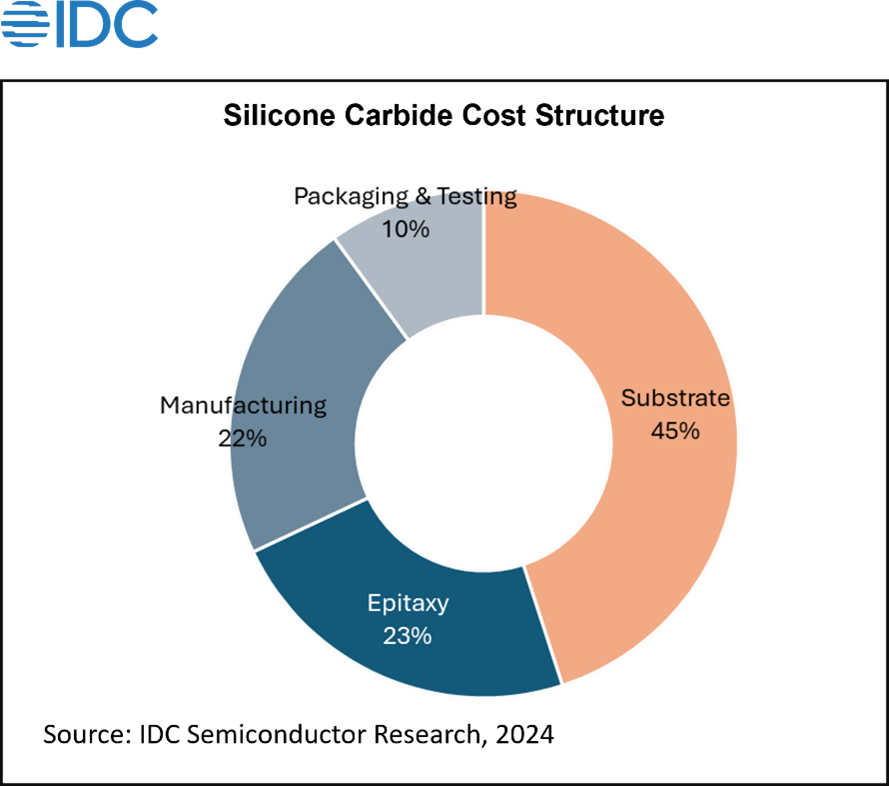

Japanese semiconductor companies need to closely monitor China’s development of third-generation semiconductors alongside its advanced process technologies.

Wide-bandgap semiconductors like SiC and GaN are vital for EVs, 5G, and green energy. The substrate is usually an issue for SiC cost, but its share of the total cost goes down from 49% to 45% due to China players being aggressive in building EPI and expanding the capacity, this will help speed up the usage for silicon carbide. We expect China will drive more impact on the market after it prioritizes the development of expanding SiC and GaN markets.

The Biden administration has included third-generation semiconductors in its “Section 301 investigation” of China’s mature process technologies, particularly in light of China’s aggressive development in this sector. Since third-generation semiconductors are also a key development target for Japan’s future, China’s expansion and movements in this sector require ongoing monitoring.

Conclusion

AI has become the key to impacting the whole industry and computing power will play a very crucial role in developing and deploying AI for all applications. To support that, a leading-edge node like 2nm will be more important.

In the meantime, we expect China players will take more actions to break through in the next AI era. To cope with the changing environment in the future, Japan’s semiconductor players need to build a comprehensive strategy, more technical innovation and new cooperation alliances will be key to building competitive strengths.