State of the India Smartphone Market

India ships around 145-150 million new smartphones per year for the domestic market, ranking it second globally after China in annual shipping volume. There are approximately 650 million smartphone users in India or about 46% smartphone penetration in the country. There is no other market of this size with such huge untapped potential, making India a very attractive market for all smartphone ecosystem participants from brands to component makers.

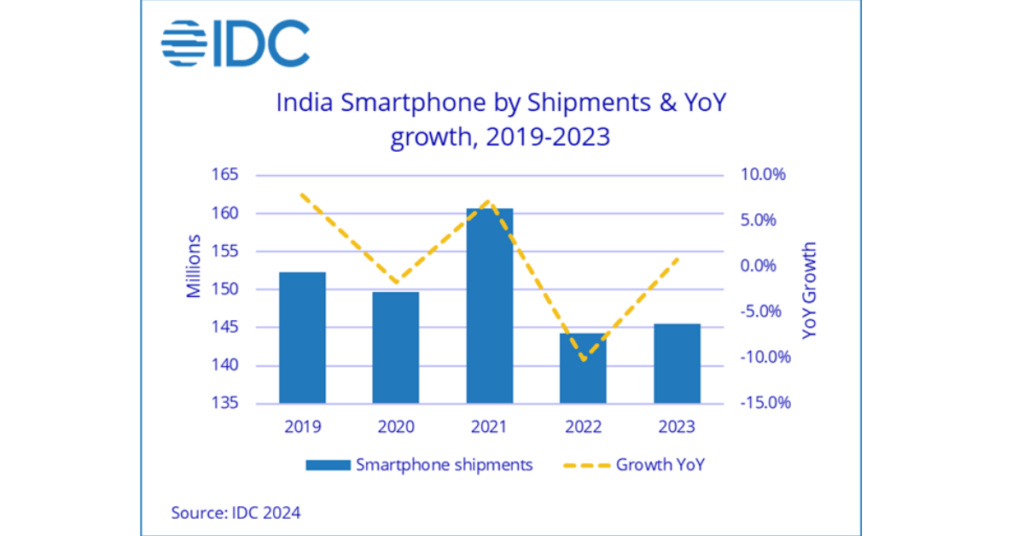

India’s smartphone market grew modestly in 2021, coming out of a challenging 2020 (due to pandemic-led shutdowns). This growth was driven by the need of a better device for remote learning/work and increasing media consumption on the go. However, in 2022 and 2023 the market faced challenges because of the rising average selling price (ASP) for devices (growing by a CAGR of 38% from 2020 till 2023), improving device quality, and continuing income stress especially in the mass consumer segment. This in turn has elongated the average smartphone replacement cycle in India from 24 months to almost 36 months currently, further restricting the growth of the new smartphone market.

Why Are Consumers Choosing Used Smartphones?

All the above mentioned factors are contributing to the increasing popularity of used smartphones in the past few years. As the quality of smartphone hardware improves, increasing device prices are keeping the new smartphone models out of reach of the mass segment. The aspiration to own a good device without paying much is making the used smartphones a very attractive choice for consumers wanting to upgrade or even with first-time smartphone users.

Another important factor in the popularity of used smartphones is the rising preference for 5G smartphones. As of now only approximately a third of the 650 million Indian smartphone users have a 5G smartphone, the rest are still using 4G phones. However, the price differential between 4G and 5G smartphones and the lack of wide availability of 5G models under INR 10K (US$125) is restricting their upgrade to a 5G device thus forcing many consumers to go for mid-priced used smartphones.

According to the latest IDC research (IDC Used Device Tracker), India ranks third globally in used smartphone units’ annual volume after China and the USA, and is one of the fastest growing markets. In 2024, IDC forecasts 20 million used smartphones will be traded in India with a YoY growth of 9.6%, outpacing new smartphone shipments of 154 million units in 2024, growing at 5.5% YoY.

Apple and Xiaomi Are the Top Choices!

The “premiumisation” of India’s smartphone market or more aptly the rising aspirations of the Indian consumer to upgrade to a mid-premium or a premium phone is also contributing to the popularity of used smartphone space. While Apple has seen healthy growth of new iPhone shipments in India in the past few years, it is also leading the used smartphone space, capturing a quarter of the market as per IDC Quarterly Used Device Tracker. Everyone in India wants to buy an iPhone because of its premium brand positioning and status signaling value, but not everyone can afford one. The used phone market comes to the rescue of many such aspirational consumers going for previous gen models like iPhone 11, 12 and 13 series.

Xiaomi led India’s new smartphone market for 20 straight quarters from 3Q17-3Q22. As a result, it has a huge user base which is reflected in the used smartphone market as well. Xiaomi sits at the second position followed by Samsung. These top 3 brands combined make up around two-thirds of the used smartphone market in India.

Who are the Market Players?

IDC’s used smartphone research tracks both second hand and refurbished smartphones being traded via organized refurbished players in the market. It excludes the peer to peer sales. In India, several startups in this space like Cashify, Budlii, Instacash, Yaantra, etc. have tried to organize this hitherto largely unorganized market. With their efforts around marketing and omnichannel presence across both online and offline counters, these players have been able to build confidence and trust among consumers regarding the quality of the used smartphones on their platforms. Cashify is one of the biggest platforms in this market with over 200 stores in 100 cities, many in Tier 2 & 3 towns.

For Yaantra, the company is owned by Indian e-commerce giant Flipkart, with branding named as Flipkart Reset. It is mainly focused on its online portfolio. For offline space, the company has partnered with Airtel to be available in the telco stores in only two Indian cities for now (Delhi & Hyderabad).

From Here, the Only Way Is Up!

IDC forecasts the used smartphone market in India to grow at 8% CAGR in the next 5 years, reaching 26.5 million units per annum in 2028.

It is evident that the used smartphone market in India is gradually taking shape with interesting channel play by key trading players making smartphones more affordable to a larger audience. This is also reassuring for the ever-discerning Indian consumer when they explore buying a used smartphone without worrying about the quality of the device and spending too much.

From an overall market perspective, growth in used smartphone market in India can certainly be a factor in increasing smartphone adoption in India, creating a parallel revenue stream for channel players, help vendors in addressing e-waste concerns around discarded devices, and generate employment (skilled/unskilled).

This market can certainly play a major role in achieving the goal of bringing a billion Indians in the smartphone fold in the next few years.