As seen in recent world news, political forces and evolving company policies have put avenues for independent content creators to generate revenue at risk. While creators are now faced with the daunting possibility that their income may be significantly cut if a major platform is forced offline, content platforms may, on the other hand, encounter new opportunities to capture share of social media and content platform markets. Two key events unfolding – a potential ban on TikTok by the U.S. government and Meta discontinuing its Reels Play Bonus Program payouts.

IDC’s Future Consumer research team continues to track and forecast online consumer engagement and digital economies, such as independent content creation. IDC’s Consumer Market Model (CMM) definition of independent content creation is non-corporate content offered in ad hoc or subscription-based platforms, such as Patreon, YouTube, TikTok, and Meta (Instagram and Facebook). Independent content creation and consumption is being embraced by consumers and online markets, driven in large part by younger Millennials and Gen Z as more than 50% of users belong to these two generational cohorts. As identified by IDC’s Consumer Pulse service, in the Home & Entertainment May-June 2022 reports, Instagram and TikTok are the leading platforms for posting by Gen Z and Millennial creators.

IDC’s most recent CMM forecasts that independent content creation will experience continued user growth worldwide with the number of people who are creating content increasing at a compound annual growth rate (CAGR) above 12% from 2021 to 2026. This continues to build on the massive growth in recent years as independent content creation have added over 1 billion new users worldwide and 43 million in the U.S. since 2019.

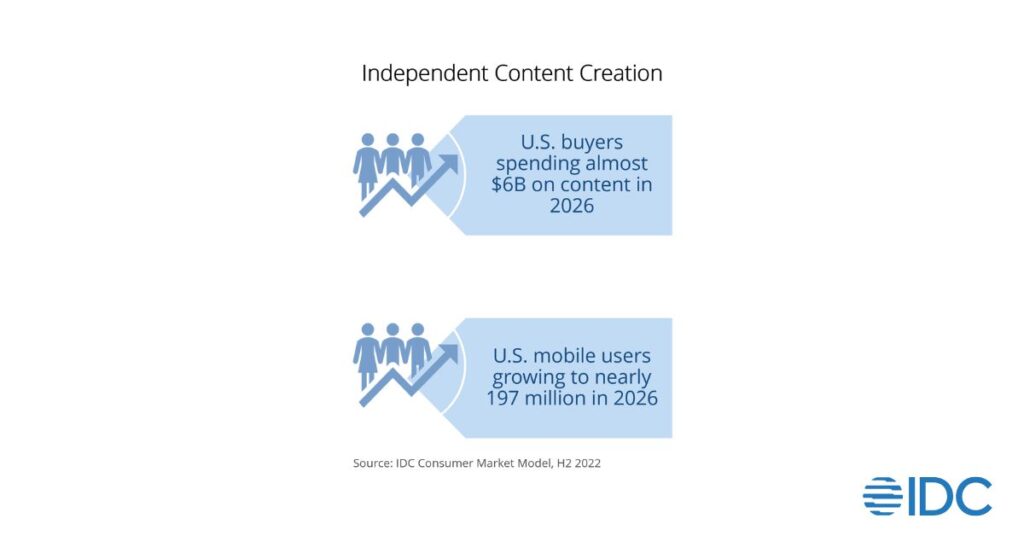

The number of consumers buying both consumer and professionally generated content is also growing quickly. In the U.S., IDC expects the market to add 2 million new mobile buyers by the end of 2026. IDC expects spending to surpass $5 billion in the U.S. by 2026, signaling a large market opportunity with persistent near-term growth. But, as seen in the political and business news in the U.S., it is a market experiencing change and challenges that might jeopardize some creators’ ability to make money.

The U.S. government is currently considering a ban on TikTok, a leading short-form content platform owned by the Beijing-based company ByteDance, as it investigates national security concerns. The previous administration issued an ultimatum to sell to an entity not under Chinese government control. Although this order was rescinded by the current administration, the U.S. government is investigating national security concerns that ByteDance could access private and sensitive data of users that will, in turn, be subject to access by the Chinese government. The Chinese government could request information about ByteDance’s customers, and the company would have to comply, endangering valuable user data like location information or using the platform to spread misinformation. The U.S. government has already banned the app on government devices but now looks to potentially ban the app on personal devices.

There has been uproar by U.S. TikTok users and content creators of claiming that their government is trying to censor them, but TikTok faces scrutiny across the globe. Notably, India banned the app for their citizens in 2020, citing similar concerns. Other major governments and armed forces have also banned TikTok on their devices due to espionage concerns. The ban has spread to U.S. allies who are also banning the app on all government devices and now considering a ban on personal devices. The decision has yet to be made by the U.S. Congress whether TikTok use will be prohibited, but if the U.S. bans the app, its allies may follow suit. Countries that already restrict the usage on government devices include Canada and the United Kingdom.

In March, Meta announced it would discontinue its Reels Play Bonus Program payouts to save money amid its current financial situation, ending certain payments to creators. Meta started the program in 2021 by investing $1 billion for influencers and content creators to earn up to $10,000 for sharing Reels that receive high plays and/or likes. As TikTok dominated short-form content, especially among the younger generational cohorts, this program was meant to combat TikTok’s market position and attract creators. Meta’s current challenging financial times notwithstanding, the move comes as the potential ban of TikTok in the U.S. could drive more creators to use Reels.

Income generated by content creation has become a key objective for many in the younger generational cohorts. The Great Resignation, along with the global pandemic, created an environment that drove consumers to try to earn money through different content platforms. IDC’s 2023 CMM survey revealed that creators making money were represented predominantly by younger Millennials and Gen Z as almost 40% reported some level of earnings. Content creators further reported that they have been earning, on average, over $22,000 yearly in the U.S.; some of which is at stake among the political fallout and business developments.

With the U.S. government potentially banning TikTok and Meta no longer paying for Reels, two of the leading revenue-producing platforms may no longer be options for creators to make income. While this causes concerns for creators, it does create opportunities for other platforms (notably YouTube with its Shorts offering) and app developers pursuing the next big thing. Content creators should continue to look at apps like YouTube to make revenue despite potentially harder and longer editing processes. Content creators should continue to diversify the platforms they distribute on and always look for up-and-coming platforms for new opportunities.

Without providing opportunities to produce income or build personal brands, platforms that host content run the risk of losing traction with top creators and may fail to attract the next wave of popular creators. Demonetizing creators may ultimately demonetize platforms and reduce traffic. These current events create an opportunity for platform creators to become major players. Platform developers would be wise to recognize the impact and risk associated with Meta’s actions when considering demonetizing or reducing monetization opportunities, as consumers will deprioritize platforms that do not align with revenue opportunities.

Money and fame are what content creators seek, and this online activity is continuing to grow. Independent content creation in terms of users, buyers, and spending is only getting bigger as shown by IDC’s CMM, and platforms that offer revenue and exposure opportunities hold a competitive advantage for attracting creators.

Do you become a major player in content creation platforms, or do you lose market share to the next big application due to reduced or discontinued revenue opportunities for your users?

A potential TikTok ban should drive investment in capturing market share rather than a pullback. Despite the news of a potential TikTok ban and Meta no longer paying creators for Reels, the future for independent content creation is bright with expected growth through 2026.

IDC tracks many online activities in the digital economy and clients use IDC’s CMM to identify emerging opportunities across a wide range of technology categories. Interested in learning more about IDC’s Future Consumer research and services?