The Asia Pacific region does not yet have its version of the European Union’s Corporate Sustainability Reporting Directive (CSRD), but IDC’s research on Trends in Sustainability Regulation in Asia Pacific is seeing an interesting pattern in changes in national policies and regulations, which will have a similar effect as CSRD. The emerging trend? Stricter regulations and more supportive policies to organizations’ Environmental, Social, Governance (ESG) commitments and progress reporting.

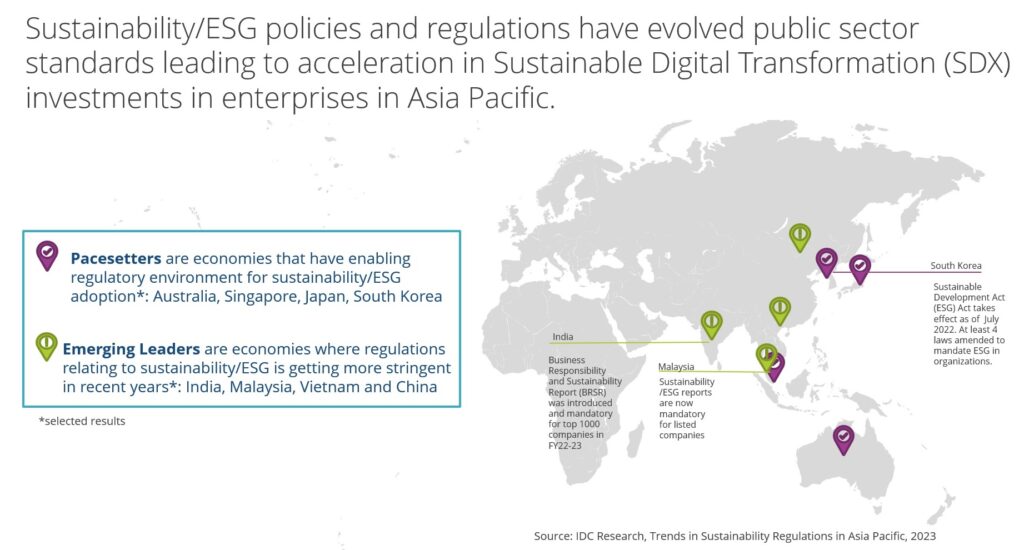

However, true to the regional nature of Asia, the driving pace of policy affecting sustainability is not the same across all countries. This has made some Asian countries, by intent or purpose, to become Pacesetters, Emerging Leaders, or Watchers for sustainability. These three distinct segments can be viewed as a country’s sustainability maturity level based on the driver of rules:

- Pacesetters are economies that have an enabling regulatory environment for sustainability/ESG adoption

- Emerging Leaders are economies where regulations relating to sustainability/ESG is getting more stringent in recent years

- Watchers are economies with more companies still planning their sustainability initiatives and are in their early stages of the sustainability journey

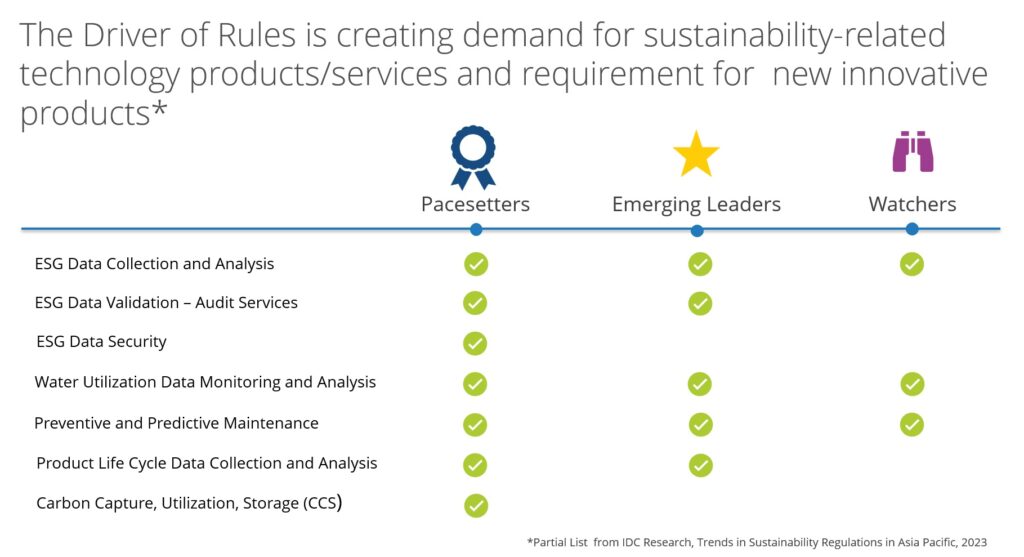

This public sector push creates increased demand for technological interventions to enable compliance, making Pacesetters and Emerging Leaders hotspots for growth opportunities for sustainability-related technology products and services. Meanwhile, Watchers are closely observing sustainability Pacesetters and Emerging leaders for best practices to emulate and follow in the future.

According to the IDC Global Sustainable Strategies and Technologies Buyer Value Survey, 2022, knowledge of the regulatory environment is among the top three important criterion for evaluation of tech providers as it relates to organization’s sustainability initiatives. This means that changes in policies and regulations in sustainability will inevitably impact not just the execution of business strategies but tech buyer’s purchasing decisions.

The top four implications of these shifts in public sector sustainability standards, and the spotlight on sustainability/ESG to the tech industry in Asia Pacific are:

Greater demand for ESG reporting technology solutions and services

Akin to submissions of annual financial reports, sustainability/ESG reports will become a regular and normal part of business operations in Asia Pacific.

The sincerity of ESG efforts by businesses in Asia is measured against the quality of the organization’s publicly available information contained in sustainability/ESG reports. Similar to financial reports where targets are specific and quantifiable, organizations will need to be more specific and set KPIs against their initiatives. New regulations are already moving toward specific disclosure of information, standard metrics, and third-party audits.

Gone are the days where companies could brand themselves as “sustainable” and then forget to support that claim with actual and verifiable proof. Recent shifts in public policies and regulations in Asia mean organizations, regardless of size of headcount or revenue, must establish commitments towards environmental and social development goals, provide baseline versus target metrics alongside public declarations, align with national set standards on emissions goals, set deadlines for ESG initiatives, and report on progress made annually.

Increased sustainability/ESG tech spending

Organizations will need to dedicate resources to ESG-related endeavors. Translating sustainability initiatives into meaningful and impactful action will require time and investment. Sustainability/ESG reports for instance will require proper planning, strategy, and execution like annual reports and financial statements preparations. This means activities such as: sustainability/ESG data sources identification, data collection and validation, information gaps resolution, and analysis and reporting will need to be integrated into business operations. The workflow requirement would also need allocated resources for leadership and personnel training on sustainability, linking plans to respective business units’ strategies and individual KPIs, and investments in ESG-technologies to manage all information requirements and additional workload.

Sustainability/ESG as an increasingly important decision-factor in procurement and partnerships

Greater incentives to comply with public sector sustainability standards will inevitably lead to the adoption of green procurement and greater demand for green suppliers. Green suppliers are product vendors and service providers that also comply with sustainability and ESG standards. Sustainability goals have supply chain emissions tracking requirements that encourage organizations to shift to more environmentally friendly providers of raw materials and services or suffer the consequence of delayed or missed ESG targets.

Organizations can recognize green suppliers by their characteristics as below:

- Tracks their own and their supply-chain’s carbon footprint/emissions

- Sets specific dates for their sustainability initiatives and goals

- Ties their sustainability/energy transition roadmap goals to KPIs

- Reports on own sustainability/ESG programs

- Practices the 3Rs – Reduce, Reuse, Recycle, in their own procurement of sustainable raw materials and packaging

- Appoints a Chief Sustainability Officer

- Promotes diversity, equity, and inclusion policies and programs

- Supports through a governance structure, environmental and social endeavors, as well as data privacy and security

- Has green certifications, accreditations, awards and recognition

Higher demand for Sustainability Talents/Services

Operational requirements needed to provide regular sustainability/ESG reports include appointing sustainability personnel to handle monitoring and supervision of the performance of ESG initiatives, progress tracking, audit and validation. Centralized decision-making would become a necessity as requirements on ESG increase and sustainability cuts across more business units and aspects of a company’s operations.

With a narrow talent market for leaders and sustainability-savvy personnel, the greater demand ushered by stricter and stringent reporting guidelines means that organizations will have to look for technology interventions and invest in upskilling of existing personnel to take up wider and deeper roles related to sustainability. As an example, accounting officers could be upskilled to know about ESG reporting frameworks, climate finance, carbon credits.

If you have any questions on how solutions providers like yourself can help your customers to adapt and benefit from these regulatory changes, we are here to help. Contact Us today and learn more about IDC research and services on Sustainability and how it can help you.