In the not-too-distant past, if you parked in a reserved spot close to a retail store, you were either in a handicapped spot or one for moms-to-be, usually designated with a sign that pictured stork carrying a baby in a cloth sac.

Today, across the nation’s parking lots, large swaths of parking lots are dedicated to curbside delivery, which skyrocketed in the wake of the pandemic. Notably, in 2Q of last year, Target’s curbside fulfillment rose by 700%.

IDC estimates that by 2023, 75% of grocery ecommerce orders (which will represent 15% of sales) will be picked up curbside or in-store (which will also drive a 35% increase in investment in onsite or nearby micro-fulfillment centers).

Covid-19 accelerated two already-rising trends considerably: ecommerce and omnichannel fulfillment. In a survey that IDC conducted in September 2020, 23% of consumers reported that they were doing most or all shopping online, that this was a change from their pre-Covid shopping patterns, and that they expected to continue to shop primarily online even after the pandemic was behind us, because “[they’ve] grown accustomed to it and prefer it.”

Additionally, 18% of consumers said that they have enjoyed the increasing availability of buy online pick up in store (BOPIS) and curbside, and that while they like to shop online, they also like to be able to retrieve their products quickly and save on shipping without a lot of hassle. They noted that they will “keep using these services even after the pandemic is behind us.”

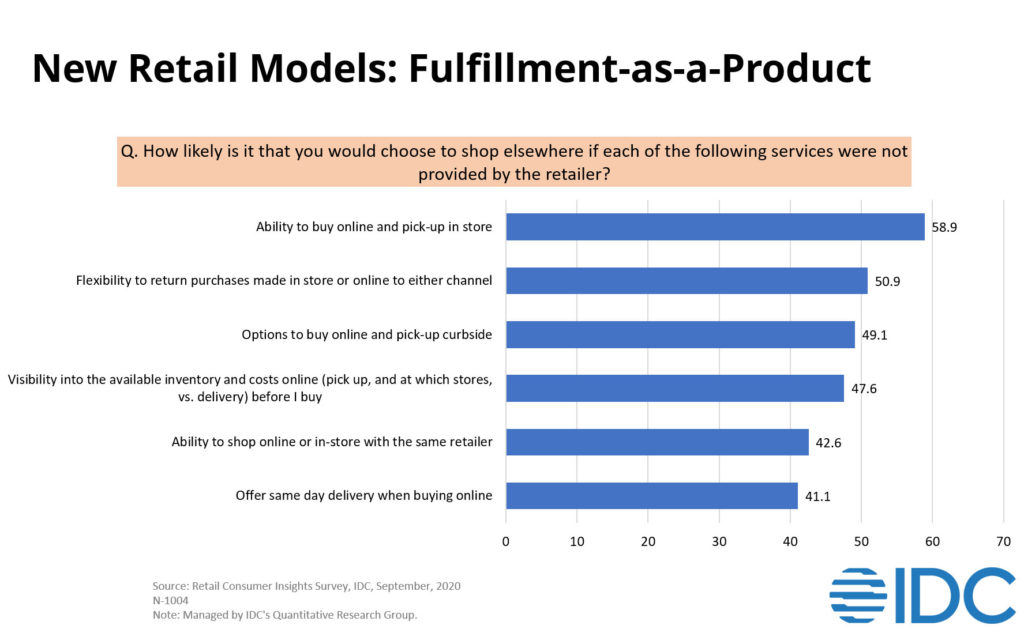

Moreover, as noted in the eBook, Kickin’ It Curbside: Meeting Customer Expectations for Omnichannel Fulfillment, consumers reported in the same survey that they will likely choose another retailer if the one they are shopping with does not offer the type of fulfillment they want. For example, 58.9% will go elsewhere if not offered buy online pick up in store (BOPIS), and 49.1% will go elsewhere if not offered curbside delivery (See Figure 1). Retailers now must think of fulfillment as part of the product being purchased. The supply chain has swiftly come face to face with the consumer.

We all recognize how ecommerce and omnichannel fulfillment have changed consumer behavior. What may not be as obvious is the enormous transformation it has wrought on employees. If we pull the lens back on ecommerce and its multiple omni-channel fulfillment variations, we can see that omni-channel has caused a massive labor shift. For each instance in which a customer wants merchandise picked and delivered to them versus going to the store and gathering those items themselves, work has been transferred from the customer to the retailer.

This is an incredibly dramatic shift that retailers are just starting to reckon with. Historically, customers have been doing much of the “work” of shopping, even if we didn’t think of it that way because it was the way things had been done for centuries. This shift of work puts an enormous strain on retailers. As discussed in the IDC report, “The Implications of COVID-19 for the Future of the Retail Supply Chain”, store operations that are not modernized to be transparent, connected, and automated — in other words, digitally enabled — put retailers in peril of not being able to serve the demands of today’s customers. Indeed, 20% of retail supply chain executives cite ‘store operations’ as the greatest focus of risk mitigation efforts at their company.

Even as retailers strive to put work back on the consumer — for example, by adding self-checkout stations, information kiosks, and price-check devices, all installed to transfer work from sales associates to the customer as well as to empower the customer and to free the sales associate for more creative and valuable tasks — they are struggling to keep up with the rising tide of new tasks that are being heaped on their employees.

The escalation of e-commerce and omnichannel fulfillment is chipping away at the labor-freeing gains that retailers are making in automating store functions such as checkout, as shoppers relegate virtually everything but the selection of products to the retailer.

Retailers now must accommodate these customer demands, which require much more labor, more and different use of space and new workflows, and which are performed partly on a one-to-one personalized path versus via “bulk” movements. As detailed in the IDC PlanScape: “Omni-Channel/Curbside Fulfillment Technology”, additional labor is needed, for example, to pick merchandise from shelves, pack or bag product, stage product for pickup (sometimes requiring refrigeration), communicate internally and externally to coordinate customer pickups, and to deliver the merchandise to the customer in a designated parking spot, service counter, locker, or other transfer point (and which may or may not still require a point-of-sale (POS) payment transaction). For ship-from-store, labor is needed not only to pick but to pack and ship. All of these operations must be handled while also attending to the needs of in-store customers — including those who are returning items purchased in-store or online. Keep in mind that 50.9% of customers report that they will likely go to another retailer if they cannot return an item to a different channel from the one they purchased it in! (See Figure 1.)

The only way to have a hope of managing this evolving landscape profitably is by digitally enabling the workflows and processes involved in accomplishing the tasks involved in omni-channel fulfillment. Many retailers have made steps toward these goals, such as The Container Store’s implementation of voice technology for curbside delivery, as detailed in the IDC PeerScape: “Practices for Omni-Channel Fulfillment in the COVID-19 Era.” And while some retailers are well out in front of others when it comes to digitally enabling their workforces, all have their work cut out for them in improving these processes and modernizing operations to meet the speed, complexity and rising consumer demands of today’s retail landscape.

How can this be accomplished? The first step is implementing omnichannel fulfillment technology. Consumers want the convenience of omnichannel fulfillment options and retailers need to empower their workforces with the tools they require to perform related tasks quickly, efficiently, and with agility. Retail workforces must be empowered not only to perform the necessary picking and delivery tasks as described above, but also, for example, be able to upsell to a customer at the point of pick up. That leads us to the second step.

Retail has evolved to be as much about how you sell as what you sell. This has brought the supply chain closer to the consumer, raised its level of importance to the organization, and requires that store associates have access to information they need, such as customer orders and enterprise inventory. Omnichannel fulfillment technology, once implemented, must also be integrated to other enterprise systems to give visibility and actionability to your workforce.

Many retailers are currently engaged in implementing technologies to automate these processes and integrate them into retail workflows. In an IDC retail survey conducted in May 2021, 55.8% of retailers reported that they are currently implementing an in-store workforce and task management solution or planning to within the next 12 months. Likewise, 60.7% reported that they are currently implementing a curbside pick-up/click-and-collect management solution or planning to implement within the next 12 months.

In today’s world of high-speed, dynamic, digital ecommerce and omnichannel fulfillment, retailers must look to modernize their end-to-end supply chains, to include orders, inventory, fulfillment, and labor. By enabling their workforces with the tools and data they need to manage omnichannel fulfillment operations swiftly, efficiently, and to consumer satisfaction, retailers can realize improved inventory turns, rising customer loyalty, increased profitability — and a happier and more productive workforce.