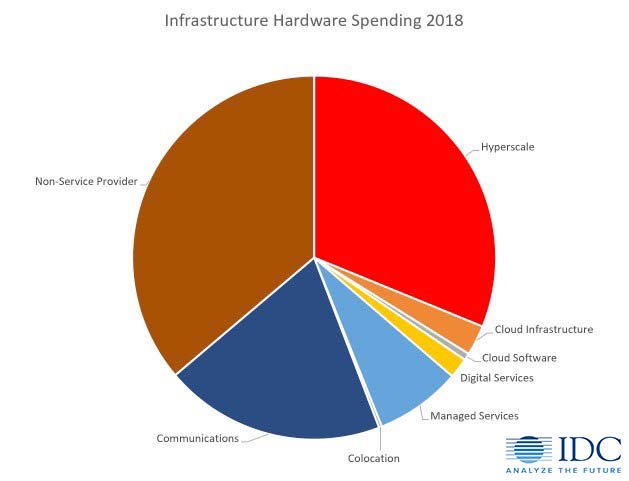

Cloud, hyperscale and digital service providers already account for 20% of IT infrastructure hardware spending, with 75% of that spending from the 8 largest hyperscalers alone. Add in colocation and managed services hosting providers, plus communications service providers, and by 2023 more than 60% of infrastructure hardware spend will come from the overall service provider segment.

While commercial end-users in other industries shift an increasing proportion of their budget to IT ‘as a service’, service providers will increasingly be the driver for IT vendor strategies and product development. From the outsize impact of hyperscalers, to the shifting focus of infrastructure and hosting providers, here are 3 ways in which these IT buyers are changing the IT market.

1. Hyperscalers Have an Outsize Impact

In the IDC Service Provider Black Book, we currently categorise hyperscale service providers as the following companies: Amazon, Google, Microsoft, Apple, Facebook, Baidu, Tencent and Alibaba. These 8 companies already accounted for 15% of server, storage and network hardware spending in 2018, and 5% of all infrastructure software sales. In the US, the proportions are even larger.

Figure 1: USA Infrastructure Hardware Spending 2018 (% annual spend on server/storage and network equipment)

The big 3 of Amazon, Google and Microsoft are active across multiple service provider segments, with IaaS revenue directly tied to investments in datacenter buildout which means that the ongoing growth of public cloud services adoption will ensure a stable medium-term outlook for spending increases.

These firms are, however, taking steps to reign in some portion of their external overheads by developing more in-house datacenter solutions based on a combination of internal product development and acquisitions, especially in the software arena. In turn, these internal solutions will increasingly be offered ‘as a service’ to the hyperscalers’ own customers.

Amazon has gone a step further, by deploying on-premise private cloud datacenters built partly around its own proprietary technologies, for end-users who are unwilling or unable to shift resources and data into the public cloud. The sheer size and scale of these hyperscalers, and their subsequent outsize impact on everything from supply chains to pricing, will make it increasingly difficult for smaller infrastructure providers to compete.

There are opportunities to do so, by focusing on niche technologies and segments through agility and partnership strategies, but the race to the bottom for IaaS pricing has already driven a rapid commoditisation of that market. The same could follow in other emerging service provider markets.

On the plus side, this change should make overall IT demand more predictable and insulated from short-term economic shocks. The increasing portion of end-user IT spend which is opex instead of Capex will result in less sensitivity than in the past, when end-users in some industries typically reacted to economic uncertainty by delaying and postponing new hardware and software deployments.

Hyperscalers are helping to drive the overall market to a model based more on consumption and usage than deployment cycles. That comes with its own challenges but should also to drive a more general stability in technology budgets than in the past.

2. Niche Opportunities Are Local Opportunities

While public cloud services have rapidly transitioned to a global commoditised market, there are other opportunities which retain a niche status and provide significant opportunities for local IT vendors who can best serve these localised service providers. Colocation providers, for example, have different needs to a typical hyperscale of public cloud infrastructure service provider, given the unique model with regards to the provisioning of commercially owned infrastructure in a 3rd party managed datacenter, typically on a more localised basis.

Digital service providers also tend to be local in their focus and are particularly engaged with the rapid emergence of new regulatory requirements and compliance relating to privacy, data retention and cross-border information sharing.

The digital services landscape is still relatively small, accounting for just 1% of global infrastructure (hardware and software) spending in 2018 with a lot of this captured by cloud service providers delivering IaaS, but consists of an increasingly complex tapestry of innovative IT buyers in areas such as the Passenger Economy, Open Banking and the Digital Grid. For IT vendors, there is a clear opportunity in targeting these more localised service providers with solutions which are tailored to their specific needs and requirements.

Whereas hyperscalers make a large amount of spending decisions at global level, the same is typically less true of emerging digital service providers. While these firms account for a smaller portion of infrastructure spending today (1% in 2018 compared to the 20% which cloud and hyperscale providers represent in the US), growth rates will be up 2 x faster between now and 2023.

The IDC Service Provider Black Book provides segmentation of ICT spending by 9 customer segments in 54 individual country markets. By using this tool, you can learn where to target the fastest-growing opportunities at a granular and tactical level.

(For a view of digital service provider revenues, also check out the new IDC Digital Economy and Markets Spending Guide which quantifies the emerging opportunity for vendors of new services such as Mobility as a Service, Data Monetization and Electric Vehicle Infrastructure services).

3. It’s Not Just About the Hardware

The initial buildout of service provider datacenters has focused heavily on hardware deployments, which has increasingly set the agenda for hardware manufacturers by driving trends such as increasing portion of storage which is located internal to server systems. In order to keep pace with the growing demand for basic server and storage cloud services, hyperscalers in particular have adopted a strategy of aggressive construction and deployment which has spread around the world in the past 2-3 years.

While some hyperscalers such as Amazon are also developing their own in-house software tools to help manage these datacenters more efficiently and effectively, service providers in general are also looking for ways to diversify their revenue streams beyond the core infrastructure services which have come to drive the first wave of IT ‘as a service’ adoption.

New opportunities will begin to emerge for vendors of 3rd Platform solutions relating to AI, robotics, IoT, AR/VR and analytics as service providers seek to engage their own customers in these markets and position themselves as a conduit for the technologies which will shape their future ability to command higher profit margins through value-added services and expertise.

In particular, industry-specific solutions offer a rich seam of opportunity, especially at the local country level where end-users are in many cases still at ground zero for adoption of new tools such as advanced AI analytics. Communications providers, for example, will target customers of their telecom and connectivity services with value-add bundles which leverage high-speed network solutions.

Managed services/hosting companies will highlight their ability to manage integrated solutions in areas where end-users are struggling to hire enough skilled professionals at a sufficient pace to keep up with their own (often larger) competitors.

Cloud software firms will seek to develop partnerships and expand their core offerings into new emerging categories, while cloud infrastructure providers are keen to build a portfolio of services which offer higher profit margins than the basic cloud services which currently dominate a large portion of their revenues. For IT vendors who currently lead in these emerging categories, this will be a double-edged sword.

On the one hand, service providers are a relatively stable and fast-growing customer segment which will be relatively insulated from short-term economic volatility. On the other hand, any migration to a commoditised ‘as a service’ model could pressurise margins and increase the buying power of these IT middlemen.

However, the biggest impact of all could be in the way that service providers increasingly set the agenda for development and deployment of new technologies, whereby the ability to deploy on a cloud or hosted platform will become prerequisite and service providers will begin to drive many of the internal prioritisation around which new technologies can be integrated with the least amount of risk for the fastest level of return.

It will therefore increasingly be a question of not if, but how to engage with service provider customers as both a channel and a customer segment for new categories and platforms.

Want to learn more about the state of the IT market? Watch our on-demand webcast: