In recent years, the scale-out file-based storage (FBS) market has seen a new momentum for innovation and adoption. A world dominated by appliance-based offerings is now seeing a rapid adoption of software-only FBS, as well as file services in the public cloud. In recent years, many OEM storage vendors have made their offerings available in public cloud marketplaces and/or are working toward co-branded services or co-selling opportunities. IDC believes this level of activity of innovation and joint engineering endeavors is indicative of the potential future of the FBS market segment.

Currently, a majority of scale-out FBS (which is also referred to as network-attached storage or NAS) is primarily deployed on premises within the datacenter for various mission-critical and non-mission-critical workloads. The COVID-19 pandemic, recent partnerships of OEM file-based storage vendors with public cloud providers, and accelerated adoption of public cloud-based file services require that suppliers and buyers alike gain a better understanding of the market segment to effectively plan for a robust infrastructure.

Performance at scale, nondisruptive upgrades, seamless extension to public cloud, flexibility in deployment models, and so on are expected of any file storage solution. In addition to making their offerings available as an appliance and in the public cloud marketplace, traditional FBS appliance vendors are beginning to proactively offer software-defined FBS, thus enabling flexibility of deployment models.

What FBS Looks Like Today

What the future entails for FBS offerings with these developments and market expectations is a burning question. To answer this, it is important to understand the realities of FBS adoption today. IDC’s 2020 IT Infrastructure Survey gives us several insights whereby customers and vendors alike can make informed decisions. Key findings include:

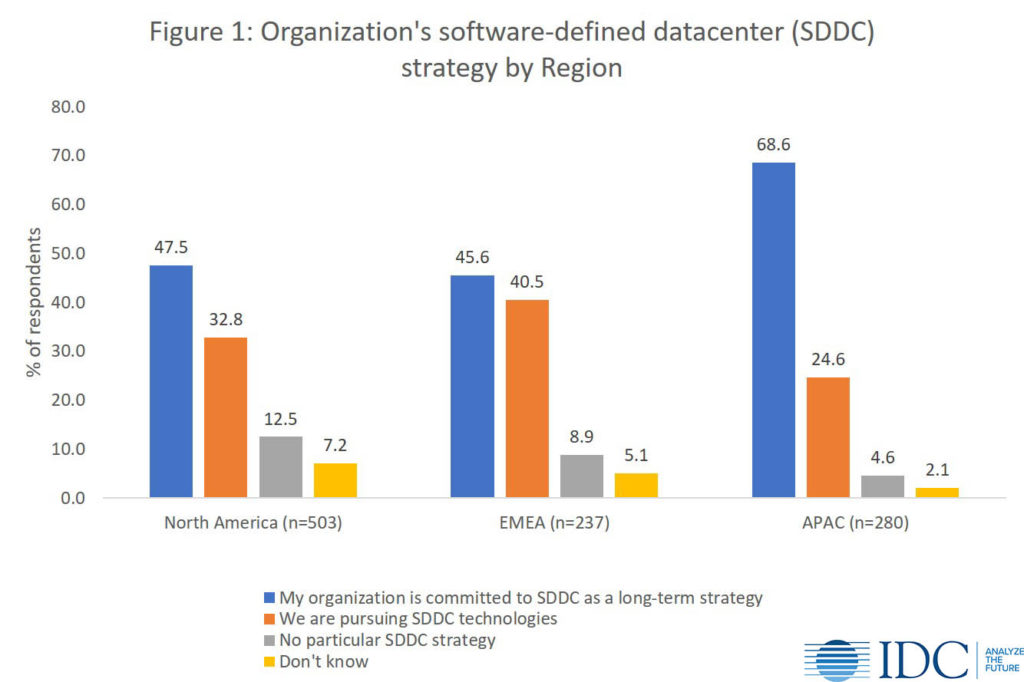

- Scale-out FBS in the datacenter. Organizations are committed to software-defined datacenter (SDDC) strategy. Asia/Pacific leads in SDDC commitment, and many North America and EMEA organizations are pursuing it in the near future, as demonstrated below

- All-flash arrays (AFA). IDC’s survey indicates that 44% respondents run less than 40% apps/workloads on AFA. As market penetration increases in the coming years, IDC expects a greater number of applications and workloads to run on AFA.

- Workloads. Scale-out NAS is the only technology that has a near-even split for supporting business-critical and non-business-critical workloads. Most other technologies one way or the other indicating that scale-out NAS has variety of configurations supporting various requirements.

Preparing for the Future

As the market progresses, end users and vendors should keep in mind that to succeed they need to have a strategy for the following:

- High-performance workloads. Scale-out FBS use cases are no longer simply traditional collaboration or file share–type workloads. Increasingly, customers are looking at FBS as a dense, performant, and cost-effective alternative for newer high-growth (in terms of revenue and capacity) workloads such as unstructured data analytics, IoT, and artificial intelligence/machine learning/deep learning. The ability to offer an FBS solution viable for traditional as well as next-generation workloads is important to sustain existing customer base and satisfy high-growth areas.

- Hybrid cloud storage and flexibility of deployment. Support for hybrid-cloud and multicloud capabilities is a must for any storage platform, especially FBS. With customers adopting a cloud-first strategy and hyperscalers investing in public cloud file services, traditional vendors must up their ante in offering their FBS solutions across on-premises and private/public cloud deployment locations. As customers strategize infrastructure road maps with cloud-first strategy, it is imperative that file-based storage solutions offer the flexibility of deployment on premises as well as in the public cloud.

- Data management. As enterprises undertake digital transformation, they will also be looking to modernize their IT infrastructures to reduce storage silos and provide data visibility and control. Metadata-based tools that connect content to context to provide granular and predictive reporting on where data is stored, define access, retention policies, and so on are expected to be integrated offerings in file systems.

Learn more about the future of scale-out NAS in IDC’s new Tech Perspective: