In a world increasingly driven by sustainability and cost-efficiency, the used device market is no longer a secondary consideration; it’s a strategic frontier. From smartphones and laptops to wearables and tablets, pre-owned tech is gaining traction across consumer and enterprise segments alike. At IDC, we’ve been closely monitoring this evolution through our Quarterly Used Device Tracker, uncovering the key trends that reveal how the market is maturing, diversifying, and reshaping the broader device ecosystem.

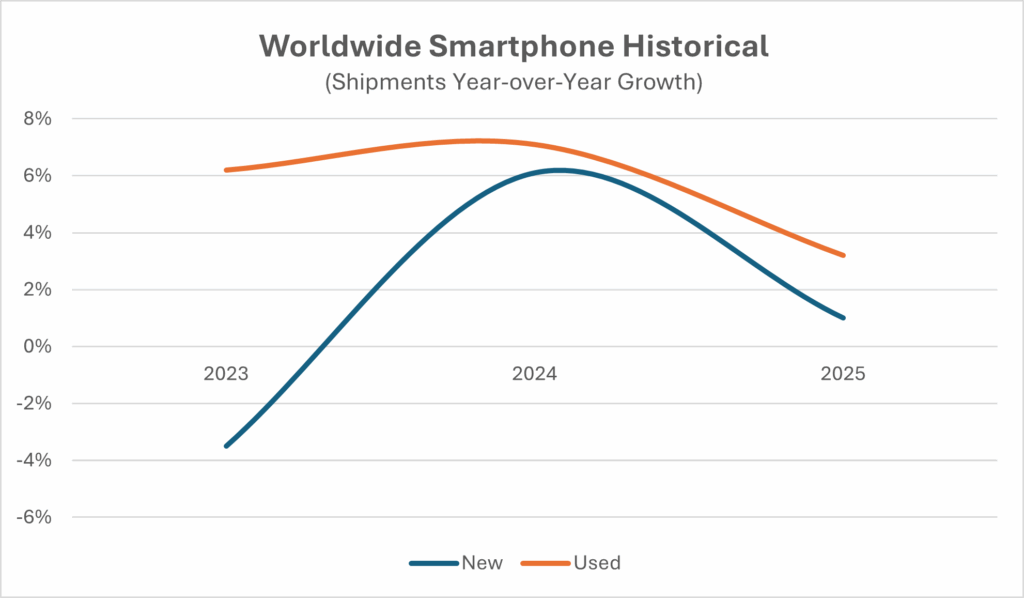

IDC’s recent forecast indicates that global shipments of used smartphones alone will grow by 3.2% year-over-year in 2025, whilst the worldwide market for new smartphones is only projected to grow 1% over the same period. This is fueled by widespread trade-in programs, improvements in refurbished device quality, and rising environmental awareness. As affordability meets reliability, the appeal of second-hand devices is expanding beyond budget-conscious consumers to mainstream buyers and businesses.

Used vs. new smartphone shipments: A diverging growth story

The smartphone market is undergoing a notable shift, with sales of new devices having declined in both 2022 and 2023, before seeing a modest recovery in 2024. In contrast, the used smartphone market has been constantly growing.

This divergence reflects changing consumer priorities: affordability, sustainability, and the growing trust in refurbished devices. As shown in the graphs below, the used device segment is not just resilient, it’s becoming a growth engine in its own right.

What’s fueling the shift

The slowdown in new smartphone shipments stems largely from economic caution and longer device lifespans. With inflation squeezing budgets and phones lasting longer thanks to improved hardware and software support, consumers are holding onto their devices for extended periods. Add to that a lack of groundbreaking innovation and saturation in mature markets, and it’s clear why growth has stalled.

Meanwhile, the used smartphone market is thriving. Buyers are drawn to the value and reliability of refurbished devices, especially as trade-in programs expand and certification standards improve. Sustainability is also playing a bigger role; choosing a used device is increasingly seen as a wise, eco-conscious decision. As consumers become more environmentally conscious, buying second-hand devices helps reduce electronic waste and makes more efficient use of resources. Additionally, the rapid pace of technological advancement means that even older models can still perform well and meet everyday needs. Consequently, the market for second-hand smartphones is thriving, often outpacing sales of brand-new devices.

Forecasting the future

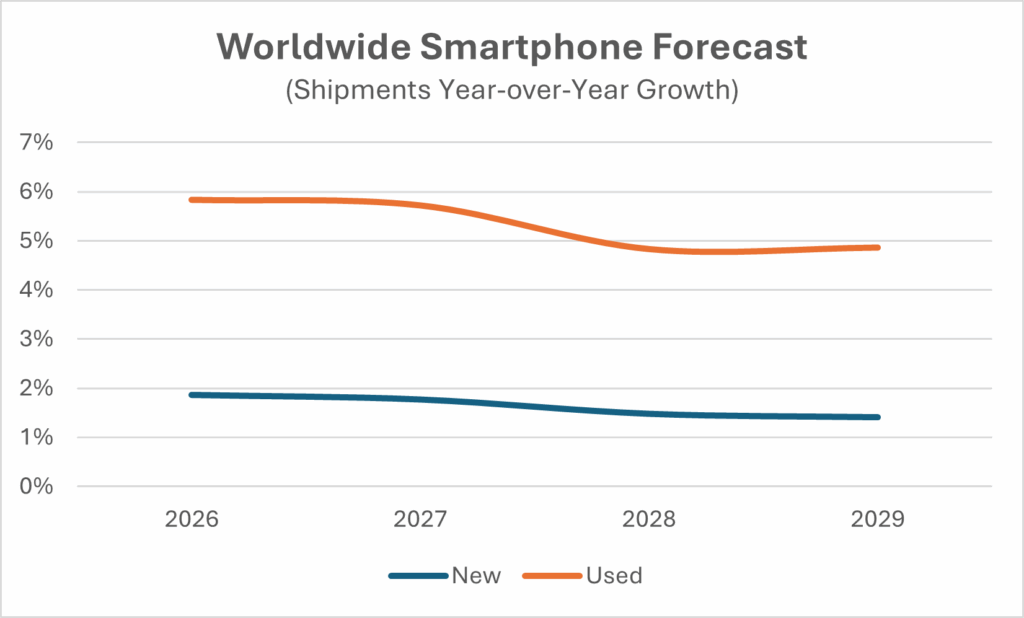

As the smartphone market looks ahead to the second half of the decade, the growth dynamics between new and used devices are expected to shift. According to IDC’s forecast, new smartphone shipments will gradually recover, with growth rates climbing from 1% in 2025 to 1.4% by 2029. This rebound reflects improving macroeconomic conditions, renewed upgrade cycles, and innovation in areas like AI and foldable devices.

However, the used smartphone market will continue to grow at a faster pace, albeit with a gradual deceleration. Starting at 5.8% in 2026, growth is projected to ease to 4.9% by 2029 as the market matures and supply chains stabilize. The sustained momentum in the used segment underscores its role as a mainstream choice, driven by affordability, sustainability, and the continued expansion of trade-in and refurbishment programs.

The graph below illustrates this, highlighting how both segments are growing, but with used smartphones maintaining a clear lead.

Looking ahead

As the smartphone market evolves, the used device segment is redefining value, sustainability, and accessibility. With strong growth expected to continue through 2029, it’s evident that second-hand smartphones have moved beyond being a niche market; they are now a strategic pillar of the industry. Whether you are an original equipment manufacturer (OEM), a retailer, or an enterprise buyer, understanding this shift is crucial for staying competitive in an increasingly circular, data-driven, and consumer-focused market.