The smartphone industry finds itself at a crossroads, grappling with market maturity and the challenges of sustaining growth. Once a hotbed of rapid innovation, the sector now faces stagnation as global giants dominate the vendor space, governments adopt protectionist policies, and profitability dwindles. Channels, too, are struggling with reduced incentives, leaving them less motivated to push new devices.

In this environment, the search for breakthrough technology has become more urgent than ever. Vendors are desperate for an innovation that can reignite consumer interest and drive large-scale replacements of increasingly durable smartphones. The stakes are high: without a compelling reason for consumers to upgrade, the industry risks losing momentum entirely.

The quest for the “next big thing” has led to bold bets on technologies like 5G, foldable displays, and AI integration. Yet, each of these innovations has faced its own set of hurdles, from high costs and limited use cases to consumer skepticism and slow adoption rates. The industry’s challenge is clear—find a game-changing technology that not only captures the imagination of consumers but also delivers tangible value. The question remains: which innovation will rise to the occasion?

5G Transition: Why It Fell Short of Expectations

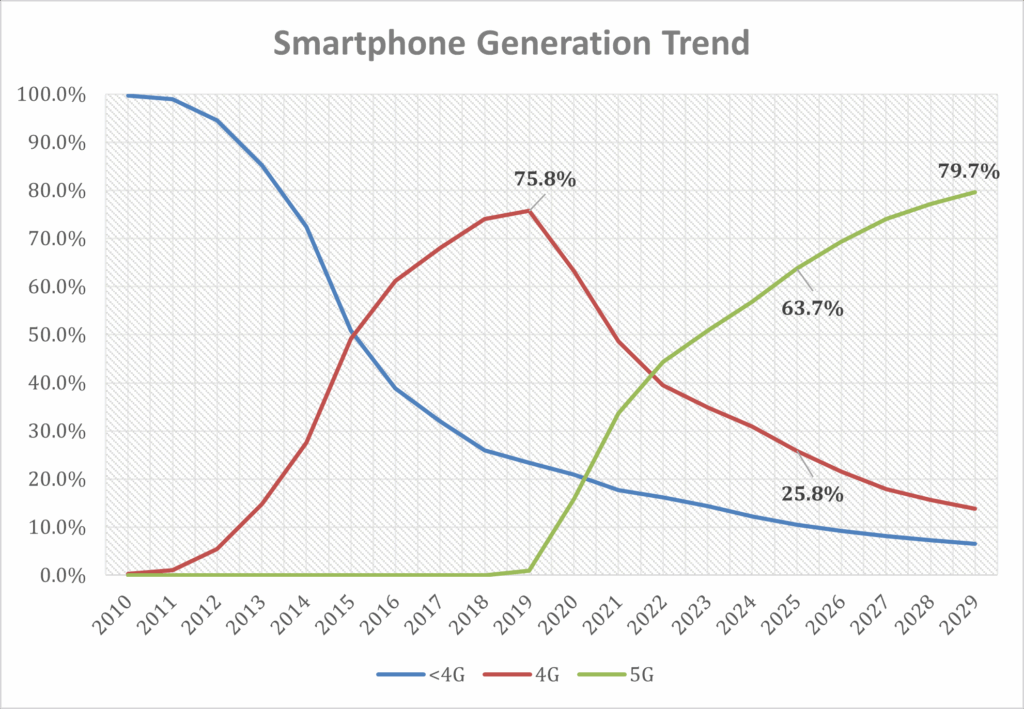

The transition to 5G was heralded as a transformative leap for the smartphone industry, yet its impact on sales and consumer behavior has been underwhelming. Several factors contributed to this shortfall, revealing critical gaps in execution and market readiness.

- Consumer Awareness and Use Case Gaps: For the average consumer, 4G already meets most connectivity needs, from social media browsing to video streaming. The incremental speed improvements offered by 5G failed to resonate as a compelling reason to upgrade. Moreover, the lack of well-defined use cases—beyond faster downloads—left consumers questioning the necessity of 5G-enabled devices. Compelling use cases never hit the mass market fast enough—“stream a video a bit faster” failed to sell phones.

- Operator Investment and Commercialization Challenges: Telecom operators faced significant hurdles in rolling out and commercializing 5G networks. Many were still grappling with the financial burden of 4G investments, which had not fully delivered expected returns. The economic downturn and market maturity further strained their ability to invest in 5G infrastructure. As a result, network availability remained fragmented, delaying the further commercialization of 5G packages and limiting consumer adoption.

- Limited Product Differentiation: Unlike the leap from 2G to 3G/4G, which introduced smartphones as a new product category, the shift from 4G to 5G did not redefine the device experience. Vendors struggled to position 5G as a must-have feature, as the technology did not fundamentally alter how consumers interact with their phones.

- External Disruption: The global COVID-19 pandemic and accompanying economic volatility slowed the pace of 5G adoption. Consumers prioritized essential spending, while vendors and operators faced logistical and financial challenges in scaling 5G deployments.

- In summary, the 5G transition fell short due to fragmented operator investments, limited consumer awareness, and a lack of compelling use cases. While the technology holds promise, its immediate impact on smartphone innovation remains muted.

5G is a foundational capability that will matter for years, but as a buying trigger it became a point of parity. It is table stakes rather than a reason to replace a still‑reliable phone.

Foldables: Dazzling Displays, Constrained Adoption

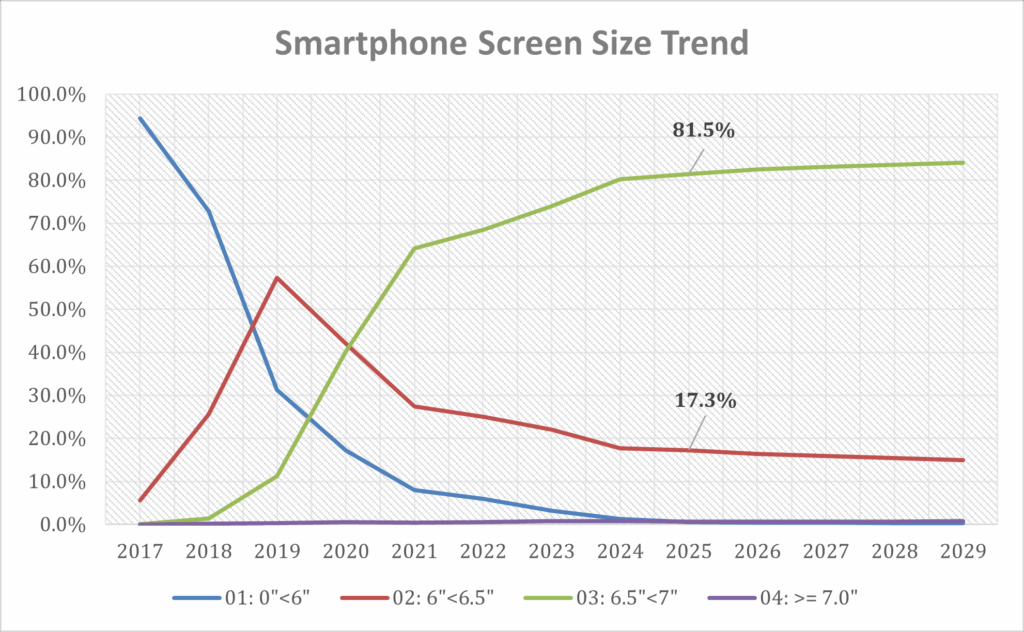

Foldable displays were heralded as the next frontier in smartphone innovation, promising larger screens in compact forms. Over the past decade, displays grew until ~6.5–7 inches became the sweet spot.

Foldables promised the next leap: tablet‑like canvas in a pocketable device. Market leaders like Samsung and Huawei have pushed the boundaries with devices like the Galaxy Fold series and Mate XT, while others, such as Lenovo and TCL, have showcased futuristic concepts like rollable and bendable displays. Despite these advancements, foldables have struggled to gain widespread adoption and remain a premium niche for several reasons:

- Price Ceilings: Foldable smartphones remain firmly in the premium segment, with an average price of $1,188 in 2025, nearly three times the cost of non-foldable devices. This pricing barrier limits accessibility and slows penetration, especially when Apple dominates the high-end market with a 74.2% share in the ultra-premium segment. In the $1000+ band, Apple dominates mindshare and market share; premium buyers often stay with the iPhone even over novel Android form factors.

- Durability Perception: Durability concerns also weigh heavily on consumer sentiment. Early foldable models were criticized for their thickness, weight, and fragility, leading many to view the technology as experimental. While these issues have improved, skepticism persists, with many consumers waiting for the technology to mature further.

- Practicality Trade-offs: Early‑gen thickness and weight—plus crease visibility—reduced pocket comfort and everyday appeal.

- Perception challenge: Despite their innovative form factor, they have yet to deliver compelling use cases that justify their high price tags. For most users, the benefits of a larger screen do not outweigh the costs and uncertainties.

Even with meaningful engineering progress and real benefits for reading, multitasking, and content creation, foldables account for a small fraction of shipments. As of 2025, foldables account for just 1.6% of global smartphone shipments, a figure projected to rise only marginally to 2.0% by 2029. While the technology holds promise, its slow adoption underscores the challenges of balancing innovation with consumer needs and market realities. They inspire excitement but not yet mass‑market renewal.

AI Integration: The Emerging Game-Changer for Smartphones

The smartphone industry is witnessing a paradigm shift with the integration of AI, positioning chipsets as the cornerstone of innovation. With large models moving from cloud‑only to hybrid and on‑device execution, chip capability—especially NPUs delivering tens of TOPS—has become a differentiator consumers can feel: faster photo/video edits, instant transcription and translation, enhanced voice assistants, and privacy‑first features that work offline. Unlike foldable displays, which primarily target premium users, AI-powered smartphones promise to revolutionize the entire ecosystem—albeit with hurdles to overcome.

Chipset Capabilities: The Foundation of AI Smartphones

AI integration in smartphones hinges on advanced chipsets equipped with neural processing units (NPUs) capable of handling Generative AI models. Devices like the iPhone 16 Pro (Apple A18 Pro) and Galaxy S25 Ultra (Snapdragon 8 Gen 4) showcase the cutting-edge capabilities of these processors.

Flagship SoCs leading the charge today include, but are not limited to:

- Apple A18 Pro – iPhone 16 Pro and 16 Pro Max

- Qualcomm Snapdragon 8 Gen 4 – Samsung Galaxy s25 series, Xiaomi 15/15 Ultra

- MediaTek Dimensity 9400 – Vivo X200 , Oppo Find X8

- Samsung Exynos 2500 – Galaxy Z Flip 7

- Google Tensor G5 – Pixel 10 series

- Huawei Kirin 9020 – Pura 80 series

However, these chipsets are currently exclusive to premium models, limiting accessibility for the broader consumer base. This exclusivity creates a bottleneck for mass adoption, as the high cost of AI-ready devices keeps them out of reach for most users.

What’s Holding AI Back (For Now)

- Premium Segment Focus: The initial rollout of AI smartphones in the premium segment is both a strategic advantage and a challenge. While it allows vendors to showcase the technology’s potential, it alienates the majority of consumers who are satisfied with their current devices. Without compelling use cases that resonate with everyday needs, the urgency to upgrade remains low. This dynamic mirrors the struggles faced by foldable displays, where high pricing and niche appeal slowed adoption.

- Consumer Confusion: One of the most significant barriers to AI smartphone adoption is consumer (and even frontline sales staff) confusion. Many users struggle to understand what AI integration truly means—Is it just ChatGPT? Does it require subscriptions? How does it enhance daily tasks? This lack of clarity extends to vendors, who are still refining their messaging and use-case demonstrations. Until the industry can demystify AI and articulate its tangible benefits, widespread adoption will remain elusive.

Despite these hurdles, AI checks more boxes than foldables as a mass catalyst: it improves daily tasks, scales through software updates, and benefits from ecosystem flywheels across Android and iOS. As models get more efficient and mid‑range silicon catches up, AI features will trickle down and create new reasons to upgrade.

On the vendor side, vendors are shifting launch narratives from spec sheets to demonstrations of real‑world AI tasks: face‑aware retouching that respects skin tone, background clean‑up with content‑aware fill, audio cleanup during calls, meeting‑notes with speaker attribution, and semantic search across photos and files.

In summary, despite the challenges, AI holds unparalleled promise to reshape the smartphone landscape. With devices already boasting laptop-level processing power, the groundwork for AI-driven innovation is solid. As vendors shift their focus from technical specifications to real-world applications, and as software solutions extend AI capabilities to mid-range devices, the network effect will drive adoption. AI is not just a feature—it’s a transformative force that could redefine the smartphone industry in the years to come.

Chipsets vs. Displays: Why Silicon Likely Wins

Four dynamics tilt the scales toward chipsets and AI over display form factors:

- Ubiquity of Benefit: AI touches photos, messages, calls, search, and work—not just screen real estate. That breadth matters.

- Faster Iteration: Software features improve monthly; displays advance on annual hardware cycles.

- Privacy and Latency: On‑device AI minimizes round‑trip to cloud and keeps sensitive content local.

- Developer Leverage: common AI runtimes and SDKs let apps target large installed bases quickly, magnifying the impact of each chipset generation.

None of this diminishes the importance of display innovation—better outdoor visibility, PWM‑free dimming, efficient LTPO, and tougher glass all raise baseline quality. But if the goal is to unlock a broader replacement cycle, silicon‑enabled experiences are more likely to convert fence‑sitters than a novel hinge.

What This Means for OEMs, Carriers, and Channels

- Lead with outcomes, not acronyms: demo a 30‑second AI workflow that saves a customer time or embarrassment; resist dense spec dumps.

- Target mid‑range bridge SKUs: prioritize NPUs and memory configs that enable smaller on‑device models for key features (photo clean‑up, summarization).

- Upskill sales teams: provide scripts and store demos to cut through AI jargon and show value quickly.

- Respect repairability and longevity: AI features should run well for multiple OS cycles; communicate this to reduce upgrade anxiety.

Lessons Learned

- Innovation must map to daily friction. If a feature doesn’t make photos, calls, or messaging better, it won’t move units.

- Affordability gates adoption. The winner will be the first credible mid‑range AI experience, not the flashiest flagship demo.

- Hardware–software co‑design beats specs‑for‑specs. NPUs, RAM, storage bandwidth, and model optimization have to be planned together.

- Clarity creates confidence. Simple explanations (and in‑store demos) beat buzzwords for mainstream buyers.

- Ecosystems compound advantage. Platform‑level AI frameworks and app integrations will outlast one‑off hardware tricks.