Historically, telcos were able to rely on providing voice and data connectivity to achieve revenue growth and consistent profit margins. However, since roughly the introduction of 3G cellular network technology and the first version of the Apple iPhone (circa 2007), third-party digital innovators have moved in to siphon off emerging monetization opportunities while curating vast developer ecosystems, relegating telcos to the connectivity provider role. Telcos have been struggling to take advantage of ever-faster networks, a growing diversity of devices, and massive popularity of social media and mobile video applications, while struggling to keep pace with ever more exacting network performance requirements, ever since.

With this backdrop, the meshing of 5G networks and API exposure can empower telcos to reinsert themselves as a key connectivity platform within the digital landscape by unlocking the ability to more easily sell and scale customized, programmable connectivity underpinned by app developer platforms grounded in telecom network APIs.

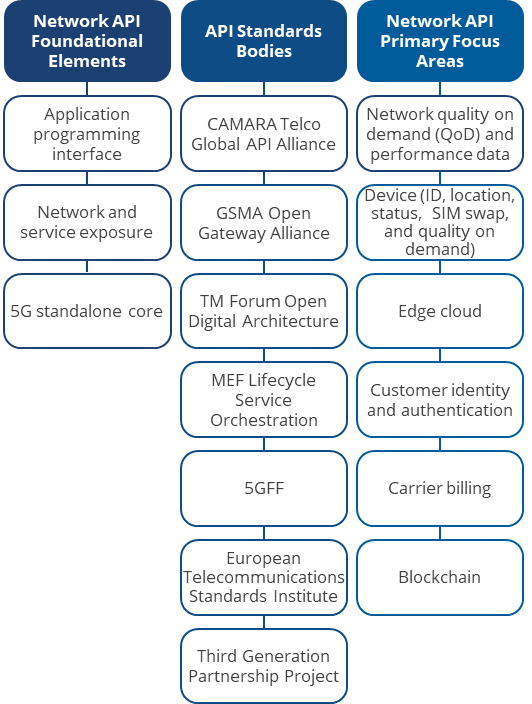

FIGURE 1: Network API Primary Segments

Telecom Ecosystem Evolution: Network API Market Makers/Drivers and Likely Roles

Telcos face several – non-exclusive – paths to market. As 5G service exposure invites a more vibrant telecommunications ecosystem, there are many stakeholders exploring how best to foster development of new API service bundle–fueled services that can generate new innovation and, by extension, new revenue from 5G service exposure. The core constituent groups are described in the sections that follow.

- Telcos: Telcos already have the ability to expose network capabilities via an API gateway enabled by the Service Capability Exposure Function (SCEF) in 4G/LTE networks; or the Network Exposure Function (NEF) in 5G networks. Telcos also provide the underlying connectivity, which could be delivered via custom network slices, guided by API and policy definitions to align with developer needs. Developing services – utilizing CAMARA specifications and/or non-standardized APIs – alongside their existing connectivity business models will bring telcos more in line with cloud and edge service providers that focus on enabling third parties to build services on top of their infrastructure. This can lead to a deeper monetization of network infrastructure and increase network accessibility and commercial engagement with application developers.

- Network Infrastructure Vendors: These vendors provide the underlying infrastructure (e.g., hardware and software) to enable the programmable 5G service. Further, vendors could conceivably end up helping build the service APIs as bundles and offer them as standalone or white-label solutions to comms SPs or platform providers alike. Vendors also stand to benefit from a robust 5G API ecosystem that can contribute to both increasing infrastructure sales required to deliver advanced connectivity services and offering them a new revenue stream. Nokia, Ericsson, and Oracle represent some of the vendors highlighting early activities in this area.

- CPaaS Platforms/API Aggregation: Communications Platform as a Service (CPaaS) providers such as Vonage and Infobip players provide a known way to aggregate and consume APIs for a range of communications services, including customer engagement through multiple channels and two-factor authentication. CPaaS and API aggregators are a natural channel partner for network APIs, broadening developer market access to these services.

- Hyperscalers: Hyperscale cloud providers (HCPs) provide a potential path for integrating network APIs via an API gateway and to integrate network performance capabilities enabled through these network APIs, along with cloud computing and storage, in order to build high-value applications in support of a number of vertical markets and use cases. HCPs all support enormous bases of cloud developers that are well-versed in API consumption and lifecycle management. HCPs are actively participating in industry initiatives such as CAMARA and the GSMA Open Gateway Alliance, and represent a significant potential opportunity.

- Independent Software Vendors or Edge Platform Providers: Independent software vendors (ISVs) can design and bundle APIs for SaaS offerings to organizations, simplifying API consumption for organizations that lack the ability to embed APIs themselves. In addition, IDC observes an emerging subset of the app platform market that focuses on enabling edge applications (e.g., IoT edge apps) that are hosted and run across edge sites. Specific platforms may focus on discrete vertical opportunities to specialize. ISVs are able to specialize in respective verticals and use cases (e.g., industrial automation, healthcare, and entertainment), providing a logical route to drive network API adoption among enterprise and industrial adopters that would be most comfortable consuming new software offerings.

Education and Training are Keys to Growth

While the potential opportunity for network APIs is potentially limitless, the key to their success lies largely in the ability for network API proponents to articulate their value in these various contexts. In particularly, the largest opportunity may be in educating the developer community on what value network APIs can bring in augmenting enterprise and consumer-facing applications, what combination of network APIs can be brought to bear simultaneously to address various requirements pertaining to Quality on Demand (QoD), edge, security, location, and a number of other network capabilities enabled by APIs. IDC believes that industry groups such as CAMARA, Open Gateway Alliance, and TM Forum will need to devote as much of an effort to educating (and potentially certifying) app developers in network API capabilities and best practices, as it is currently devoting to establishing and proving out their technical capabilities.

For a deeper dive into these topics, watch IDC’s July 10th webinar, ‘Revenue Enablers for the Future Telco: APIs, AI, and Emerging Tech”.