Last year, we observed around 1,800 outsourcing deals, or more than $96 billion in total contract value (TCV.) Considering the deal entry delay effect, the final TCV for the year should extent to around $110B-$120B, or around 2,200 deals. This performance is much weaker than 2017’s and 2018’s total contract values, but this is largely due to the cyclical nature of government contracting.

Note that this analysis is based on IDC’s Services Contracts Database (SCD), which includes publicly disclosed deals only. Entry delay refers to the lag in our data collection process, which we offset by projecting TCV and activity. Outsourcing deals include IT outsourcing, business process outsourcing (BPO), managed carrier network outsourcing, pure SaaS, independent testing, and others (see IDC Services Taxonomy).

Fewer US Government Contract Vehicles

In the government sector, TCV dropped from $197 billion in 2017 to $119 billion in 2019 and fell even further to just $49 billion in 2019. This drop in overall TCV can be attributed to fewer US government contracts this year. Western Europe government signings, by contrast, tripled in TCV. The government side signing is cyclical by nature; a large US government contract vehicle/program can take a few years to be divvied up into discrete awards (task-orders). Therefore, the large vehicles awarded in 2017 and 2018 have been behind the reported revenue and booking growths of some large US government contractors in 2019, and probably will continue to be well into 2020.

Most of outsourcing TCV was IT related. The US federal government continued to consolidate and modernize IT infrastructure and legacy applications, and to improve back-office efficiency to free-up more funding for new operational capabilities. Key single-vendor awards included:

- Department of Defense (DoD) Washington Headquarters Services’ $10B cloud infrastructure deal

- Defense Information Systems Agency’s (DISA) $6.5B network deal (awarded to GSM-O)

- The National Aeronautics and Space Administration’s (NASA) $2.8B workplace outsourcing contract (awarded to NEST)

Looking forward, based on the timing of contract vehicles alone, we expect government outsourcing to continue to be light this year, but it will likely trend up again towards the second half of next year. However, given the current COVID-19 pandemic crisis, the outlook is uncertain.

Stable Commercial Signings

On the commercial side, we saw almost 1,400 outsourcing deals, or almost $47B of TCV. We project the final TCV to end up around $50B. This represents a 6% increase over 2018’s TCV, and 16% over 2017’s TCV.

Quick highlights on the commercial side include:

- Bigger deals: we observed six commercial outsourcing deals that were over $1 billion, with a combined contract value of $8.4B – slightly higher than 2018’s mega deal TCV ($1B+)

- Increased communication deals: Communication & media (mainly telecom)’s share of TCV for the year jumped to more than 21%

- North America and Western Europe together accounted for 88% of the worldwide TCV: specifically, the US commercial sector saw more than $16 billion in TCV; another $17B came from the UK, France, DACH (Austria, Germany, and Switzerland), and the Nordics combined.

In contrast, the pro emerging markets did not fare as well:

- Latin America’s TCV share shrank due to lower activity

- CEMA’s (Central & Eastern Europe; Middle East & Africa) TCV share shrank largely due to smaller deals

- Asia Pacific’s share dropped to below 8.5% (even much lower if we exclude the two large carrier network outsourcing deals.) 2019 was challenging due to economic slowdowns in China and India, the trade war between the US and China, and other factors. Given the current Covid-19 crisis, we expect the downward trend to continue but likely to stabilize sometimes in H2 this year – yes, severe damage, but relatively more predictable.

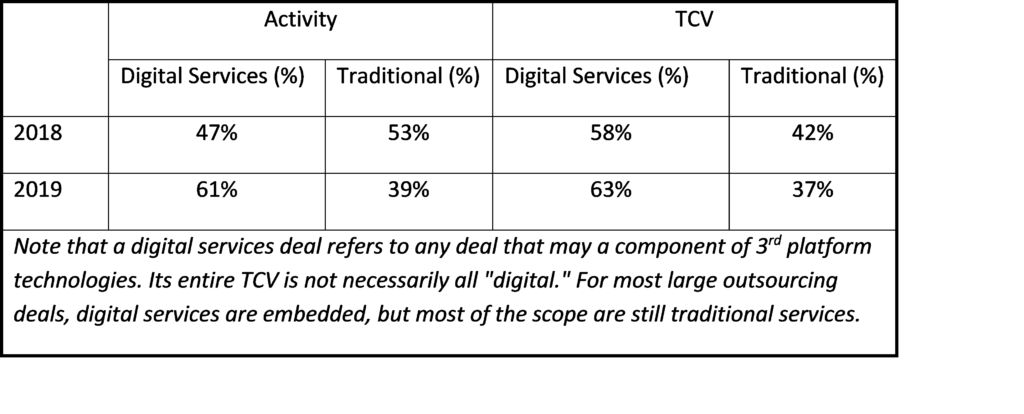

2019 in “Digital”: Digital Services Deals Review

We observed around 1,150 outsourcing deals in 2019 ($11B in TCV) that involve some 3rd-platform technologies, namely social, mobile, analytics, cloud, or IoT. They are also considered digital services deals (see IDC Services Taxonomy definition of Digital Services.)

Cloud First

Almost 90% of the digital services deals involved some cloud components. While cloud adoption is nothing new, there were few observations that worth noting:

- Size: Most of the cloud-enabled deals happened in the very large deal space: 10 out of the 14 billion-dollar plus outsourcing deals in 2019 were cloud related

- Public cloud getting more mainstream: Larger public cloud deals are “mainstreaming” traditional large logos. Since 2013, the year that debuted the Central Intelligence Agency (CIA)/ Amazon Web Services (AWS) deal, public cloud providers have been gaining traction in the $100M+ deal space. This was more noticeable during the last three years. For example, Microsoft’s Azure has scored some of the biggest cloud infrastructure deals in 2018 and 2019

- Multi-cloud: We are seeing more and bigger multi-cloud engagements (buyers opted to outsource their infrastructure and core apps to multiple public and/or private cloud providers at the same time.) These multi-cloud deals were few and far between a couple of years ago. However, last year we saw almost $7B worth of outsourcing TCV involving multi-cloud. Yes, it’s still a small bite out of the pie, but still telling. At least the very large organizations are more comfortable with the “true cloud brokerage” model than they were a few years ago.

Analytics and Artificial Intelligence (AI)

In 2019, we saw more than 340 outsourcing deals with some analytics components, or $32B in TCV. This represents a sharp decline, but mainly because the government sector and the timing of big government contract vehicles. On the commercial side, both activity and TCV gained handsomely year over year.

Within these deals, we observed almost 130 contracts that involved some AI components, including machine learning, natural language processing (NLP) and others; these contracts represent $24B in TCV. IDC believes that the actual AI/ML work in these contracts remains small compared to “traditional” analytics services.

Most of these projects go hand in hand with cloud. Big infrastructure and application outsourcing are increasingly depended on AI/ML to automate and streamline processes. Also, although we are still a long way from true “plug and learn” and “fully trained” AI machines. There are more tactical/functional AI powered APIs and micro-services pre-loaded with some limited pre-trained models. Cloud delivery is the only way to consume these services.

| Customer/Vendor | Industry | Tech/Scope | TCV | Length | Deal ID |

|---|---|---|---|---|---|

| AT&T/IBM | Telecom | hybrid cloud, multi-cloud, infra, open source/Red Hat/Linux | $2B | 5 yrs. | 96040 |

| AT&T/Microsoft | Telecom | multi-cloud, IaaS, AI, IoT, social, cyber security | $2B | 5 yrs. | 96042 |

| Banco Sabadell/IBM | Banking | Hybrid cloud, IaaS, open source/Red Hat, AI, compliance | $1B | 10 yrs. | 98941 |

| Bayer/Capgemini | Pharma | public cloud, IaaS, multi-sourcing, unified communications, digital transformation, supplier mgt, BI | $454M | 10 yrs | 98456 |

| Invacare Corp/Birlasoft | Medical Devices | public cloud, IaaS, compliance, e-commerce, PLM, SAP, ITSM, analytics | $240M | 7 yrs. | 97614 |

| NS-LIJ*/Allscripts | Healthcare | private cloud, HER (health electronic records) | $600M | 8 yrs. | 97921 |

| Naturgy/IBM | Utilities | hybrid cloud, AI/Watson/reinforced learning, BI, IoT, blockchain, smart meter/smart grid, cyber security | $454M | 10 yrs. | 95218 |

| Sabre/Google | Transportation | public cloud, business analytics, (improve) customer services, digital transformation | $225M | 10 yrs. | 99203 |

| WHS*/Microsoft | Government | cloud, IaaS, PaaS, AI | $10B | 10 yrs. | 97746 |

* North Shore-Long Island Jewish Health System (NS-LIJ)

*Washington Headquarters Services (WHS) – a UD DoD Field Activity

* Subscribers of the Services Contracts Database, please click on the services deal id to obtain additional deal detail

*Non-Subscribers should contact Xiao-Fei Zhang or your IDC account manager for more information

What’s Coming: Deal Renewals

For IDC-observed technology and business outsourcing deals ending in the next two years, or between 2021 and 2022, (excluding those already identified as being extended, renegotiated, or cancelled), there is $327 billion in expected TCV.

Key highlights include:

- Government renewals (19 $1B+ deals, 386 $100M+ deals)

- Banking, financial services and insurance (BFSI) & Manufacturing (40 $1B+ deals, 42 $100M +deals)

- The Americas (45 $1B+ deals, 360 $100M+ deals)

- EMEA (15 $1B+ deals, 170 $100M+ deals, most activity on commercial side)

- Asia Pacific (5 $1B+ deals, 24 over $100M deals)

Under normal conditions, we would expect most of the contract values would be renewed smoothly, with the lion’s share going to the incumbents and a small heathy portion exchanging hands. There are no major signs of “insourcing”, and cloud/automation effect is predictable and continuous.

The Future is Uncertain in the Face of COVID-19

However, the COVID-19 pandemic is disrupting work, life, and the global economy. Many regional industries are shut down, and major offshore/nearshore countries, like India, Czech Republic are also under lock-down. Borders are shut indefinitely. Outsourcing deal renewals in 2020 will not be “business as usual.”

Outsourcing is largely considered non-discretionary spending, and sharp economic downturns, at least by itself, can be a driver, at least for low-cost providers. However, this time the downturn will likely hit harder than before. And more importantly, we are facing unforeseen uncertainty as the scope of the virus and its impact on production, supply chains, and demand will determine when the recovery phase begins and how quickly it progresses.

Given the travel shutdown and demand side uncertainty, we expect the dampening of sales cycle to be immediate: while core operations/app managed services contracts will mostly stay intact, we expect scope expansion-related discussions to be either delayed or taken off the table altogether.

Buyers are likely to be disinclined to switch vendors now. This may favor the incumbents; however, based on what we have seen following the 2008-2009 recession, they should expect tough price re-negotiations ahead. On the delivery-side, we also expect India’s shut-down to hurt the supply side, albeit not as severely as China’s shutdown affected the global supply chain.

Industry exposure will also be a deciding factor: for example, in travel & logistics, travel will be hit the hardest, while logistics companies may expand contract scope. Healthcare (payer, provider, and pharma/life sciences) and some government contracts are likely to be more stable and even experience some upside. Even there, it may depend from account to account.

Mid-term and long-term effect will be much more difficult to gauge. We believe that overall, workforces and employees can adapt to the new normal – most services can be delivered remotely, or to be substituted with automation altogether.

This crisis will force enterprises and consumers to adopt the online model faster, and government to remove regulatory barriers. Even big decisions can be made without CIOs meeting delivery teams in person. This will accelerate digitalization and the substitution effect is likely to stay even after the crisis. However, given the uncertainty of the global demand, will this gain in productivity translate into larger contract value or further price erosion remains to be seen.

Learn more about IDC’s Tracker products and how organizations use IDC’s robust market data to influence decisions: